Binance Pool Announces $500M BTC Miner Lending Project

- Binance Poolannounced a $500 million project to support the crypto mining industry and provide them short term loans to get out of the bearish market.

- The $500 million project will provide loans to the crypto firms for a term ranging from 18 to 24 months at a previously specified interest rate.

- The interest rate has been stated to range from from 5% to 10% and the firms taking loans will have to offer security as well.

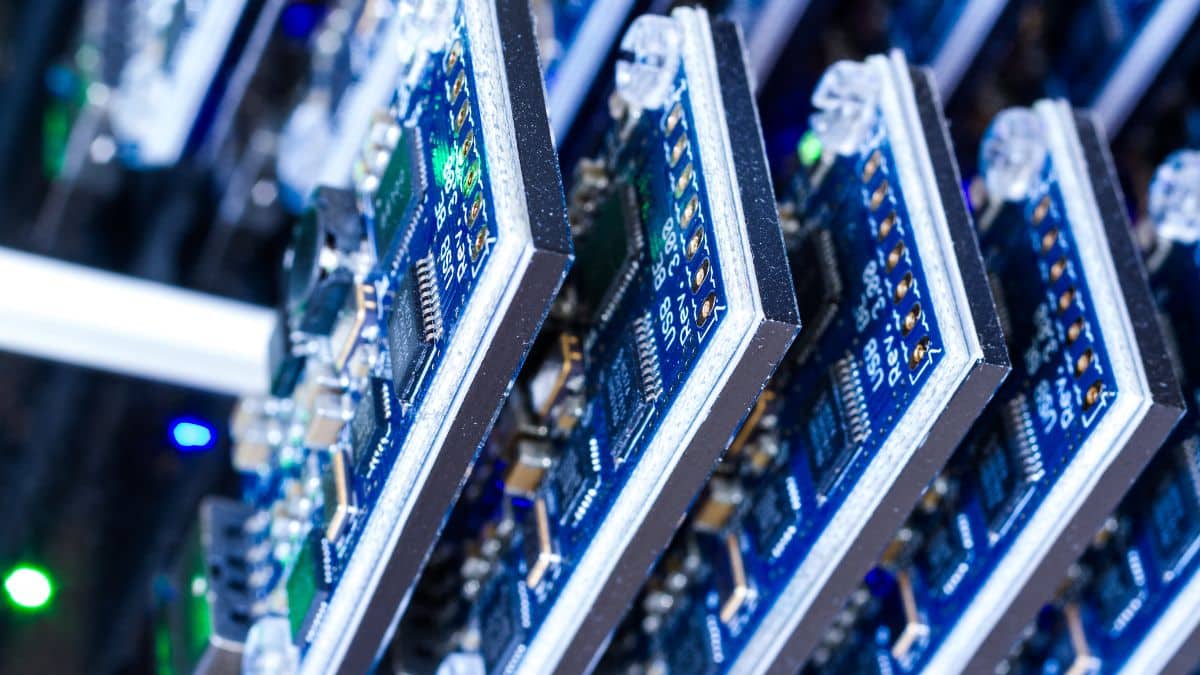

Binance Pool, a platform dedicated to improving the income of miners, has announced a $500 million project to support the crypto mining industry and help them overcome the bearish market situation wherein the price of Bitcoin (BTC), the world’s biggest cryptocurrency, has dropped significantly from its all-time high witnessed on November 10, 2021 at a price of $69,000.

The exchange’s $500 million project will provide loans to the crypto firms that need in this bearish market conditions. The loan will be provided for a term ranging from 18 to 24 months at a previously specified interest rate.

The interest rate has been stated to range from from 5% to 10% and the firms that take the loan will have to offer security, either physical or digital assets, satisfactory, to Binance

“In light of current market conditions, Binance Pool is launching a $500million lending project to support crypto miners and digital infrastructure providers. The first of its kind for Binance Pool, this project was designed to provide secure debt financing services to both public and private blue-chip bitcoin (BTC) mining and digital asset infrastructure companies globally,”

said the world’s biggest crypto exchange.

Interestingly, Binance also confirmed that it will debut several cloud mining products which will help the broader Bitcoin mining industry and provide additional hash rate to support the mining ecosystem. The announcement from the exchange pointed out that the “cloud mining hash power will be directly purchased from bitcoin mining and digital infrastructure providers.”

The exchange is also looking for cloud mining vendors to work with the exchange and help it with the goal of debuting crypto products.

The crypto mining industry hasn’t remained untouched from the bears that currently dominate the market. Due to a significant decline in revenue, major manufacturer of crypto mining chips Nvidia confirmed losses in the second quarter of 2022.

“As noted last quarter, we had expected cryptocurrency mining to make a diminishing contribution to Gaming demand. We are unable to accurately quantify the extent to which reduced cryptocurrency mining contributed to the decline in Gaming demand,” .

the company noted in its Q2 report.

Another crypto mining firm Compute North filed for Chapter 11 in the U.S. Bankruptcy Court for the Southern District of Texas and as per the filing, the firm owes $500 million to almost 200 creditors. Following a decline in revenue it was revealed that its CEO stepped down.