Among the different exchanges and trading platforms that have made retail investing popular in the past, very few have become as popular as Robinhood. While Robinhood started out as a one-of-a-kind brokerage service that made investing and trading easier for retail investors, much of that advantage has been wiped out by the subsequent developments in the industry.

In this Robinhood review, we analyze Robinhood as a broker and try to identify what kinds of investors and traders it is most suitable for.

What is Robinhood?

Robinhood was initially launched as a trading and investing platform that aimed to disrupt the brokerage industry.

The major competitive advantage that Robinhood had in the industry was that it did not charge any commissions at all, and offered access to a variety of trading instruments including equities, options, cryptocurrencies, as well as forex trading.

This move was hailed as being widely popular at the time, and it drew a lot of attention to Robinhood, making it incredibly popular. However, over time, most of the brokerage industry realized that they were losing a lot of their market share to Robinhood, and matched it by also removing commissions from their fee structure.

At present, very few brokers in the industry charge commissions for trades, relying instead on PFOF or spread-based methods to earn revenues. However, Robinhood still has a large audience owing to the fact that it developed a strong level of customer loyalty within the younger segment of the trading market.

By appealing to younger, more tech-savvy investors in the market through a simplistic design and a focus on the basis, Robinhood has been able to continue growing, albeit at a slower rate than before. In addition to this, they have also recently launched a new range of services, which includes a cash management account and a recurring investment feature, both of which we shall be discussing later in this review.

Robinhood Review – Pros

The Robinhood trading platform has several pros associated with it, which include:

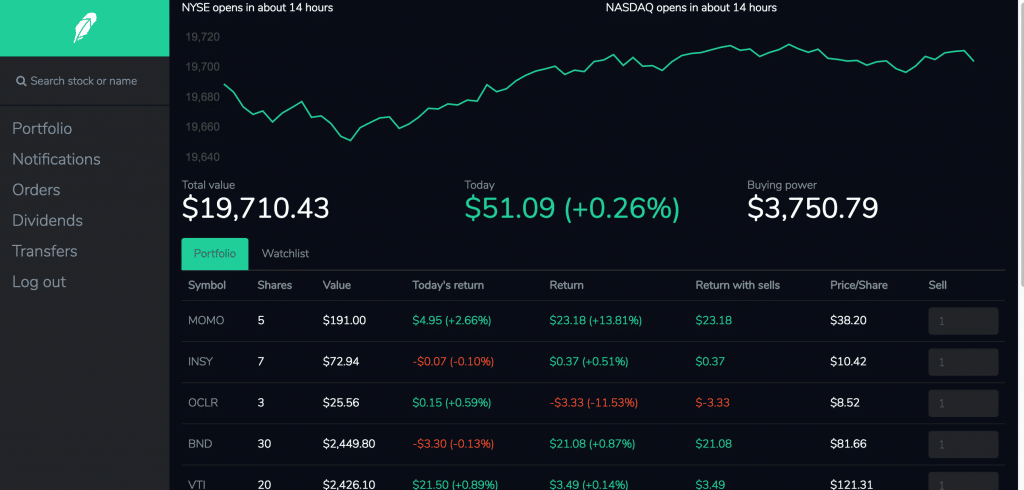

Easy to Use Robinhood App

The mobile app is available for download on both Android and iOS devices and offers an easy and convenient way for you to invest and trade in the market.

Unlike other trading platforms and exchanges that are usually designed to maximize the number of features provided, Robinhood chooses to focus on simplicity. Their app has been designed in a way that is easy to navigate and quite intuitive, which adds to the customer appeal of the app.

Additionally, even though the trading app has a fair number of features and options for advanced traders, the focus is on simplifying the process as much as possible, so the default setting on the platform is to provide the simplest settings and then allow users to customize the interface based on their preferences.

The simple design of the app ensures that newer investors or traders will not be dissuaded or intimidated by the sheer number of features that are present to them, and they can make the journey to becoming experienced investors at their own pace.

Large Variety of Assets to Trade

Through the mobile app, Robinhood users can easily trade a very large variety of assets, which is part of the reason why the app has become so popular.

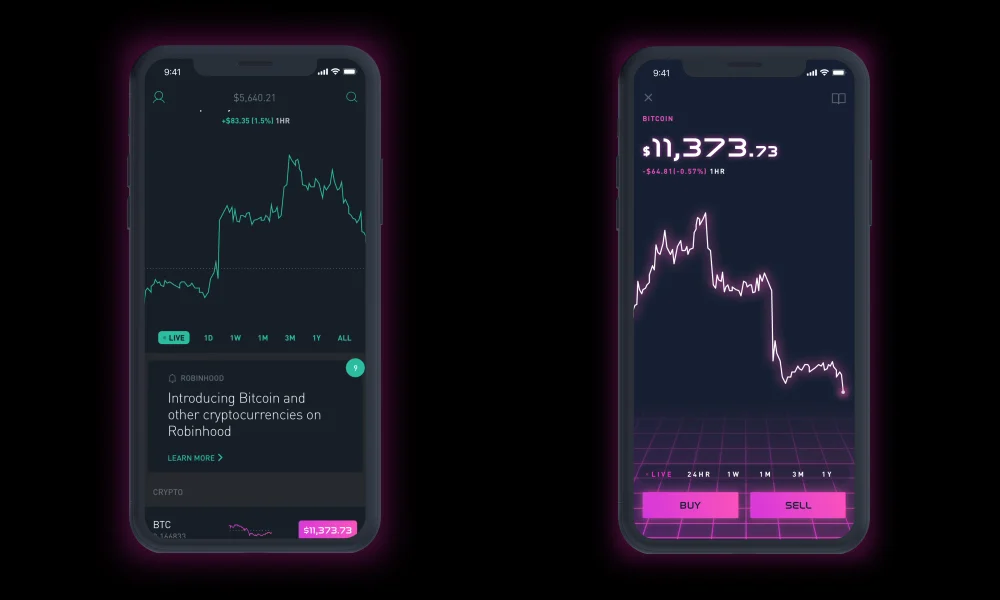

For starters, you can easily buy and sell most major cryptocurrencies through the mobile app with little to no commissions involved in the trade.

However, Robinhood is not just a cryptocurrency trading platform, it is a brokerage service that provides access to a variety of other asset classes too. For example, through the mobile app, you can trade stocks, ETFs, as well as derivative contracts such as options.

This has made Robinhood incredibly popular, especially among younger investors who do not like having multiple apps if they wish to trade different asset classes. With Robinhood, you can trade all the asset classes on one single platform, making it a lot more convenient and giving Robinhood a competitive advantage in that regard.

Fractional Purchases

Most popular assets, whether they are cryptocurrencies or stocks, are usually quite expensive. For example, if you consider the case of cryptocurrencies, most investors, especially at the beginning of their learning curve, might not be able to spend $30,000 to buy 1 Bitcoin (BTC).

However, Bitcoins can be purchased in smaller segments, and you can buy Bitcoins through most major cryptocurrency exchanges worth as little as $1. While this is a feature that is quite popular in the cryptocurrency space, it is not quite as well known in the stock market, where individual stocks can also cost thousands of dollars.

Robinhood fixes this problem by allowing investors and traders to purchase fractional shares. Therefore, they can choose to buy a very small part of any asset that they wish to trade, using the amount of their choice.

Cash Management Account

Robinhood also offers a variety of cash management features that allow you to earn up to 0.30% APY on your idle cash. This is in excess of the interest that most banks in the US are paying right now to users for their checking account balances, which in most cases is 0.

In addition to this, another advantage of the Robinhood cash management features is that you can easily withdraw money using any one of the 75,000+ ATMs that Robinhood has in its network.

Fully Digital Account Opening

The process for opening an account with Robinhood is also quite quick and straightforward and involves little to no time commitment on the part of the trader or investor.

For example, if you wish to open an account on Robinhood, you can do so directly through the app, and the process is quite simple. It only takes a few minutes to sign up for a Robinhood account, and once you have been verified, you can add funds to your account and begin trading right away.

Educational Resources

The cryptocurrency world is fast-changing and dynamic, with new technologies emerging and making older ones obsolete every other day. In such a world, it can be hard to keep track of all the developments, which might be intimidating to users.

Additionally, there are several Robinhood users who are only just starting out in the world of blockchains and cryptocurrencies, and they might not know how they function and what the key elements are.

For such users, the suite of educational resources provided by Robinhood is incredibly useful. Robinhood provides a series of video classes and exams that aim to educate users about cryptocurrency trading as well as the latest developments in the space.

No Account Minimum

The cryptocurrency markets are known for their volatility, which in turn means that several newer investors or traders might not want to risk a lot of their capital into such investments.

For such users, Robinhood is the right platform to target, because it does not have an account minimum deposit for users to begin trading through the platform. For instance, users can deposit as little as $1 and begin to trade stocks, options, as well as cryptocurrencies through the platform.

The lack of an account minimum deposit makes it a very useful platform for newer investors.

Highly Regulated

Robinhood is a publicly listed exchange on the equity markets, therefore, this means that it is also one of the most highly regulated exchanges, especially in the cryptocurrency space.

Due to its public listing, the trading app has to maintain a certain degree of transparency and is often audited by regulators such as the Securities and Exchange Commission to ensure that the platform is in a general state of financial wellbeing.

Therefore, in a world where most cryptocurrency exchanges are entirely unregulated, the Robinhood trading platform offers a useful alternative by providing investors and traders with a safe platform in which they can park their cryptocurrency assets.

Robinhood Review – Cons

Every coin has two sides, and the Robinhood trading platform is no exception. There are several cons associated with the platform, which include:

No Mutual Funds or Fixed Income Products

One of the biggest disadvantages associated with trading through Robinhood is that the platform does not support any mutual funds, making it quite hard for people to passively invest their money unless they choose to do so through ETFs.

At the same time, a lot of fixed income products cannot be traded through Robinhood, such as commodities or bonds. Additionally, even with regard to derivatives, only options can be traded, and futures trading is not available on Robinhood.

For a platform that attributes quite a large part of its success to the fact that it allows users to easily trade any asset class they like, these shortcomings make it slightly unattractive as a platform for more sophisticated investors.

Robinhood also does not support IRA or retirement accounts.

No PFOF Data

Since Robinhood does not charge commissions on the trades that are made through the platform, it has another source of revenue, called the PFOR or the Payment For Order Flow system.

What this means is that whenever you place an order on Robinhood, the order is then directed towards a market maker, who then executes the order for you. This provides the market maker with liquidity, and they use this to reduce their own risk. However, there are a variety of issues with the PFOF process that have made it controversial over the past few years.

However, the important thing to note here is that for PFOF brokers, one of the biggest factors that determine how quickly a broker can execute trades will depend on the quality of the market maker used. Most such brokers often release PFOF statistics so that investors and traders can then compare this with other brokers and use this data to make the best decisions.

Robinhood, on the other hand, does not publish such statistics, and therefore, this makes it very hard to compare the performance and the execution times with other brokers. Thus, there is no way of knowing whether the order execution processes used by Robinhood are more accurate or quicker than its competitors.

Weak Customer Support

Another problem with using the mobile app is that its customer service is known for being quite poor and unresponsive, especially when it comes to solving major security issues or serious customer queries.

For a platform that is designed specifically for beginner traders and investors who might have questions and queries, the fact that Robinhood has a bad customer service team does not bode well and can reduce the appeal of the platform for some investors.

Trading Restrictions

One of the biggest disadvantages of the PFOF model that we discussed earlier is that it places Robinhood at the mercy of the market makers through which it chooses to direct its orders, who often also have investment divisions that might be negatively affected by the retail trading volume. This can lead to outages and other similar problems.

Notably, Robinhood has faced problems in the past, such as last year when the firm froze the trading associated with GameStop shares. There were several outages in the firm, and at several points, the app simply did not let users place orders. Additionally, several investors complained that their positions were force-liquidated by the platform against their consent.

While this is not a major issue for long-term investors, it is still concerning and sheds light on the quality of the platform as well as the level of trading restrictions that could be imposed by the PFOF model utilized by Robinhood.

Robinhood History

As we mentioned earlier, Robinhood was initially launched in 2015 as a way for users to invest in the stock market without having to pay the hefty commissions that were prevalent within the retail investing space.

However, in response to the growing popularity enjoyed by Robinhood, several other brokers also started to reduce the commissions that they charged and eventually scrapped commissions altogether. This reduced the competitive advantage that Robinhood had, and it began to expand its suite of product offerings to include options, cryptocurrencies, as well as ETFs.

However, in 2021, the company faced a lot of backlash in the aftermath of the GameStop incident, when several users complained of outages and entire periods where they could not trade at all. Robinhood was also invited to testify at the Congressional hearings held as a part of the investigation into the incident.

At the end of the incident, Robinhood agreed to pay a $70 million fine in order to settle the regulatory investigations into its conduct. In addition to this, Robinhood also faced a lot of backlash regarding its misleading advertising and communications, such as misleading customers, approving beginner traders for risky strategies, as well as technical difficulties which made it difficult for users to access the platform when they needed to.

The platform has also begun to develop a new set of tools, such as dividend reinvestment programs, cash management tools, as well as a recurring investment plan in order to continue to appeal to the younger audience that the platform once enjoyed. Each of these features has been discussed in this review.

More recently, it announced in April 2022 that it will be rolling out Crypto Wallets that will be provided to a waitlist of over 2 million people across the world. As a result of signing up for this wallet, customers will be able to easily send and receive any of the cryptocurrencies that they can trade on the Robinhood platform.

The company also announced that it will be building a brand new, non-custodial web3 wallet, for which it will be accepting waitlist applications soon. Robinhood expects that the Beta version of this wallet will be ready by Q3 2022, and it will roll out the final product to all the users on the waitlist by the end of 2022.

Robinhood Cryptocurrencies Available

Robinhood’s cryptocurrency offering is quite limited and only includes 7 main coins. However, these include most of the major cryptocurrency tokens that are currently being traded on the market.

The complete list of cryptocurrencies that you can trade through Robinhood’s cryptocurrency offerings is:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Bitcoin SV (BSV)

- Dogecoin (DOGE)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Litecoin (LTC)

Robinhood Fees

For any crypto trading platform, there are two main types of fees that it normally charges users – trading fees and non-trading fees, A brief explanation of each of these types of fees, along with the Robinhood fee structure, has been provided below.

Trading Fees

Trading fees refer to any fees that are paid as a result of using the platform’s primary services, which in this case is the buying and selling of cryptocurrencies and digital assets. Most cryptocurrency exchanges charge transaction fees in one of two ways: they either charge spreads or commissions.

Spreads

Spreads refer to the difference between the bid price and the ask price. This model is primarily adopted by market-maker trading platforms that assume the position of the counterparty in the trade. Therefore, you are effectively trading against the platform.

When this happens, there is usually a difference between the price at which you can buy the asset and the price at which the asset can be sold at any given moment. The buying price, also called the bid price, is almost always higher, and the difference between these two prices is called a spread.

What this effectively means is that if you were to buy and sell an asset at the same time, you would actually incur a loss.

Commissions

The other form of trading fee that might be charged by an exchange is a flat commission on every trade that you make. This is usually a very small percentage of the trading volume and is done in a decreasing manner, i.e. the higher your trading volume, the lower the fees that you will have to pay in this regard.

Robinhood Fee Structure

Robinhood does not charge users with spreads or commissions of any form, and instead makes the majority of its revenue from the PFOF system that we discussed earlier.

Non-Trading Fee

In addition to the trading fee, cryptocurrency platforms often also charge a variety of other incidental fees and charges that are not directly linked to the trading activity on the platform. These have been discussed in detail below.

Deposit Fees

Most cryptocurrency exchanges charge fees in order to allow users to deposit money into their accounts. On Robinhood, there are no deposit fees charged by the platform.

Withdrawal Fees

Similar to deposit fees, most cryptocurrency exchanges also charge fees if you wish to withdraw money out of the platform. When you wish to withdraw money from your account, there are no withdrawal charges associated with it.

Robinhood Platform Features

There are a variety of services and features associated with Robinhood. As we discussed earlier, even though Robinhood simply started out as a way for users to invest and trade without paying commissions, it has evolved to become so much more than that. The major components of the Robinhood Ecosystem have been discussed below in detail.

Dividend Reinvestment Program

One of the key features that Robinhood provides is the ability to reinvest your dividends into the initial investment. This is particularly useful for stock investors.

Whenever you receive a dividend on a stock, Robinhood gives you the opportunity to auto-invest it into the same stock again, thereby enabling you to compound your returns over long periods of time.

Recurring Payments

Another new feature that Robinhood has added in order to expand its suite of offerings is that of allowing users to make recurring payments to a particular security.

For example, suppose you wish to invest a fixed % of your paycheck into Bitcoin every month. With Robinhood’s new recurring investment feature, you can do so automatically, by selecting a fixed investment amount and setting the frequency to monthly.

Once you do this, every month, Robinhood will deposit the fixed amount into your Robinhood account and invest it into Bitcoin automatically. This is a good feature for those who are long-term investors and wish to Dollar-Cost Average their investments over long periods of time.

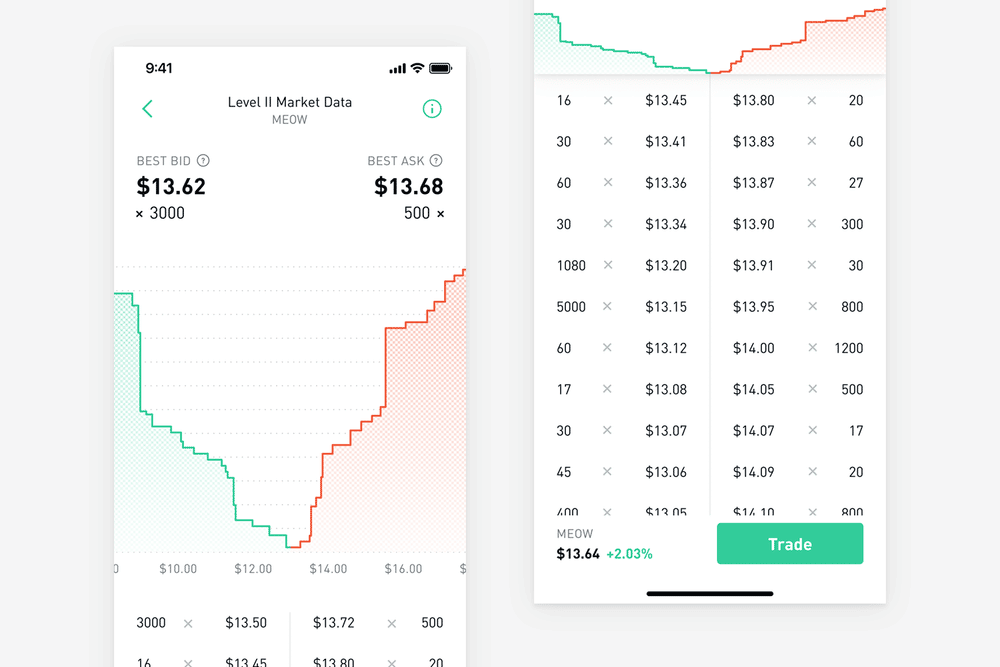

Robinhood Gold

Robinhood Gold is the premium service offering launched by Robinhood, and it is aimed primarily at experienced traders. This feature allows traders to buy securities with a margin and also provides them with access to premium research.

The cost to join Robinhood Gold is merely a monthly fee of $5, and it offers research information on over 1,500 securities through the use of Morningstar. Additionally, users of Robinhood Gold also have access to Level 2 Quotes and access to margin loans, enabling experienced traders to place larger orders after conducting a more thorough research into the company.

When you subscribe to Robinhood Gold, the initial subscription fee of $5 that you pay includes a variety of features, including the interest payment on your first $1,000 borrowing. This means that you can make a trade of up to $1,000 more than the capital that you have without risking any more of your own money, which helps traders to magnify their profits on any given trade. However, at the same time, trading on margin also means that users will have magnified losses, and this reduces the margin of error that you have on any given trade.

Any additional margin that you borrow in order to use on the platform will require interest payments of 2.5% per year, which is quite low. These interest payments are billed annually to your account. A key factor to note here is that any account that wishes to subscribe to Robinhood Gold and trade on margin should have a minimum balance of at least $2,000 to cover the margin requirements.

Robinhood Safety

Since Robinhood has a very high daily trading volume, it is susceptible to cyber-attacks and hacks, which means that it has to maintain a very efficient and robust security system in order to combat this. It does so using a variety of features, which include:

Biometric Authentication

Users can log into the Robinhood App through their biometric identification if the feature is available on their smartphone, such as a fingerprint ID.

Alternatively, users can also use a custom 6-digit PIN to log into their accounts.

Two-Factor Authentication

Robinhood also encourages users to set up a two-factor authentication process on their devices, which will protect them from any cyber-attacks.

For example, if anyone wishes to withdraw funds from an account, they will be required to enter a pin from the Google Authenticator app, which can only be accessed through the user’s phone. This ensures that no one except for the owner of the account can sign into the account.

Insurance

Robinhood is also a member of the SIPC, an organization that enables Robinhood to protect the deposits made by users onto the platform. Under the SIPC, Robinhood deposits are protected for up to $500,000 or $250,000 if the claim is made for cash.

Robinhood – Final Verdict

If you fall into the group of beginner investors and are looking for a simple, safe way to begin investing, then Robinhood is the right place for you to start. This is because it offers a wide product range, a simple platform, as well as the ability to trade without having to pay any commissions.

Even though the controversies associated with Robinhood have tarnished its reputation and have led users to doubt Robinhood, it still provides a variety of useful services and features that make for a very good trading experience. However, it is important to consider that the platform does not have any transparency associated with its PFOF systems while trading.

- $0 for brokerage account

- No annual, ACH or inactivity transfer fees

- Streamlined interface: Easy to use interface

- IPO access

- Cryptocurrency trading

- 1 Free Stock after linking your bank account

You have the possibility to lose money when trading CFDs with this provider. Only invest what you can afford to lose.