Are you looking for a platform to invest your money for long-term or short-term gains? Various online platforms offer different trading options that you can cash in and earn a profit on your investments.

However, the choice of platform depends not only on the popularity of a platform but on the reliability and trade options a platform offers you. It is also essential to consider how safe your investment is and whether you can diversify or control your investment when you need to.

What Is eToro?

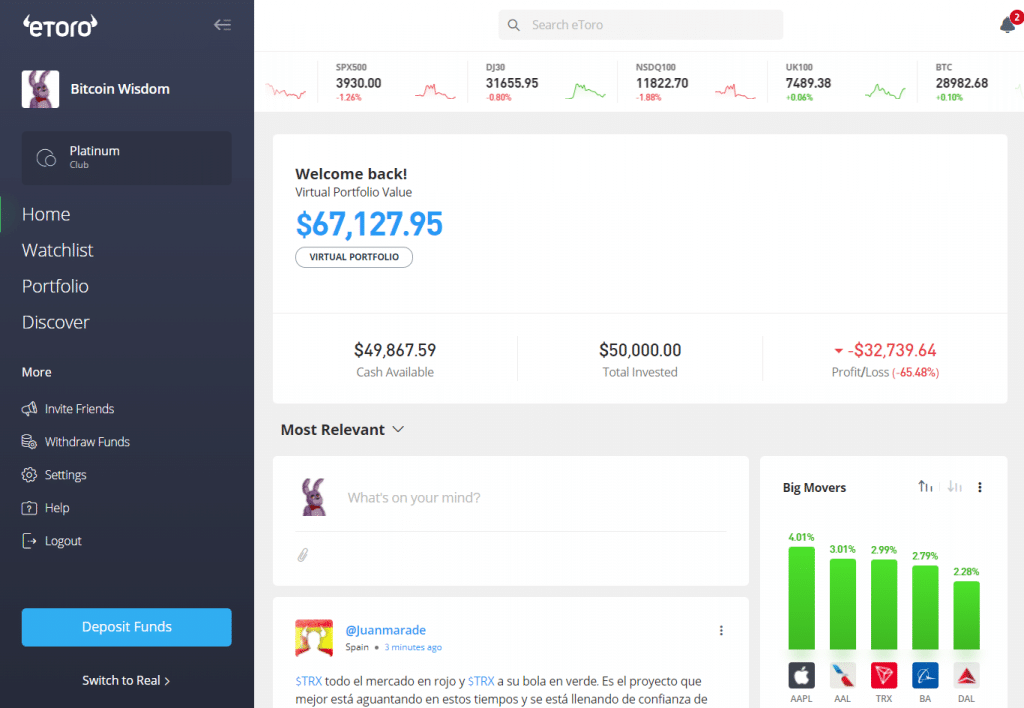

eToro is a social trading platform that allows you to trade or invest in stocks, commodities, foreign currencies, or other assets, including cryptocurrency, also known as a digital currency. This platform allows you to invest a capital amount of money and use it to transact in different stocks from anywhere around the world.

eToro is unique in its capital offerings because you can use it for Contract for Difference (CDF) transactions. These CDFs allow you leverage in transactions based on your capital investment to enable you to diversify your trades and profits.

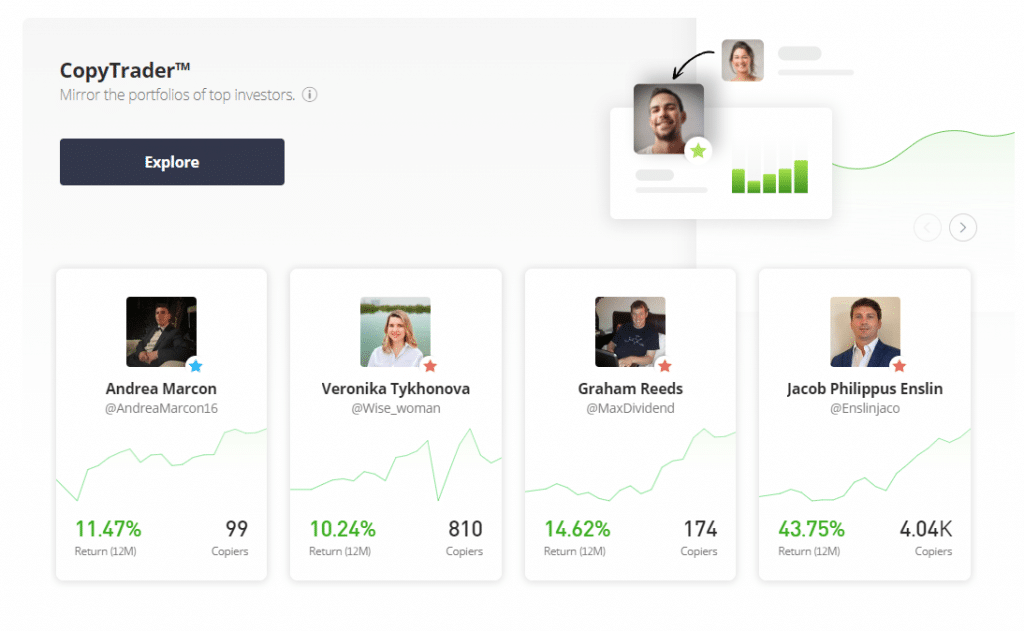

eToro is also unique in its offerings as it allows you to copy the trades and portfolios of other traders on the platform, albeit for a fee. eToro also has a widespread social networking community that enables traders to exchange ideas and forecast trades.

When Was eToro Established?

eToro has been a widely-known player in the forex market. It first started as an online forex brokerage firm going by Retail Fx in Tel Aviv, Israel, in January of 2007.

This company was founded by Ronen Assia, David Ring, and Yoni Assia. The trio went ahead to create a brokerage firm that would be more accessible and user-friendly than what was available on the market then, so they set up shop in Israel and began accepting clients from around the world.

eToro’s founders got the inspiration to start a social trading platform from the success of social networks like Facebook, YouTube, and Twitter. They believed that online marketplaces would be more effective if built around user-generated content. They set out to create a platform where investors could learn about and trade in the financial markets through a social trading platform.

eToro Company Overview And Growth Path

eToro relaunched in September 2007 as a Visual FX trading platform with a new and revolutionary online trading offering for its users. eToro clients could now have better control of their trades and investments as they could now get visual graphic representations of their transactions.

In May 2009, eToro launched its Webtrader, an intuitive online platform that could allow its users to trade financial assets from anywhere. This platform was made available for both seasoned traders and beginner traders alike.

eToro continued to grow its wings in the financial markets, and in 2010, it launched OpenBook, the first-ever social trading platform in the world. OpenBook revolutionized the world of trading by allowing eToro users to study each other’s trade patterns and copy them to make a profit.

OpenBook took forex enthusiasts by storm immediately after it launched. This program won the Finovate Europe Best of Show 2011, owing to its revolutionary success and popularity in the forex industry.

In response to technological advancements in the finance markets, eToro launched a mobile trading app in April 2012. The application known as eToro mobile app combines the features of WebTrader and OpenBook, available on both iPhones and Android mobile phones. With this eToro mobile app, users can access their accounts and perform any transactions on the go.

In 2013, eToro took a step further and introduced stocks into their trading portfolio. This move allowed eToro users to diversify their trades and investments by accessing a stock market piece. eToro continues to add more stock options to its platform for users to choose from at any given time.

eToro launched its revamped eToro interface for online traders. This new interface combined the features of both WebTrader and OpenBook in one to improve and centralize its user’s trading experiences.

Still, in 2013, eToro added Bitcoin trading to its platform. eToro was the first platform of its kind to offer digital asset or cryptocurrency trading to its users.

In 2016, eToro introduced Copyportfolios. This trade option allowed users to copy and invest in specific portfolios built from specific trade themes, assets, or strategies in the platform. The collection of portfolios extends across different markets, including 5G, renewable energy, cloud computing, or any asset or theme that is at any one time attracting the attention of users to help them diversify their trades and investments.

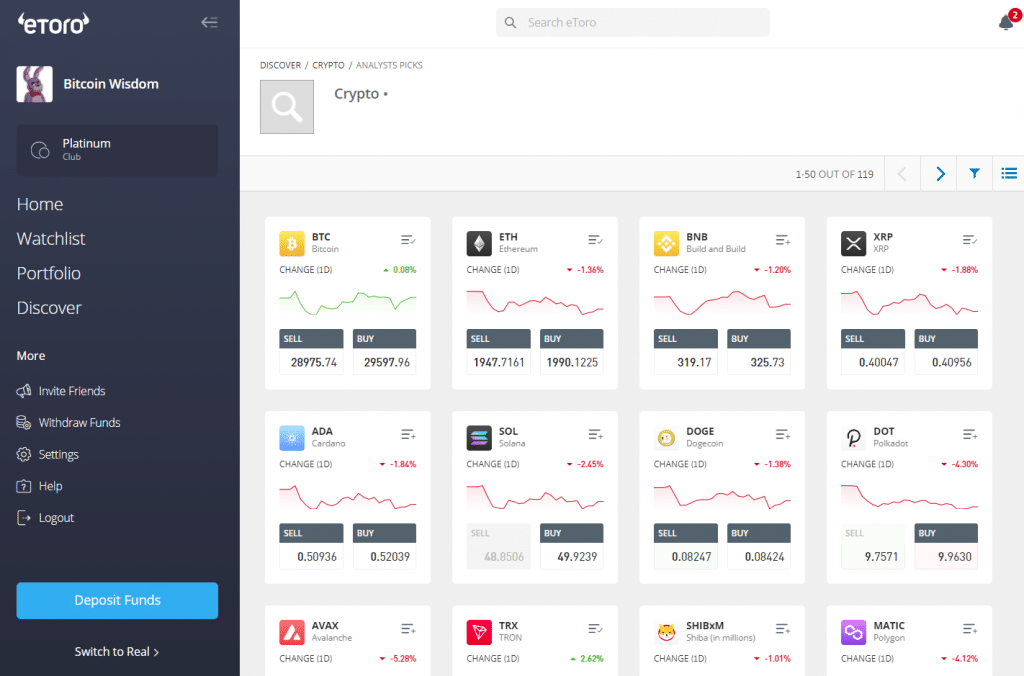

In 2017, eToro added more digital assets or cryptocurrencies to its platform. These new digital assets include Ethereum, Litecoin, XRP, and others performing well in the market.

eToro extended its crypto trading to the American market by launching the US crypto platform in 2019. This platform allowed users in the US to expand their trades to the cryptocurrency arena for more significant profits.

In May 2019, eToro scrapped all its portfolio management services fees. This year, eToro scrapped stock commission fees for its users worldwide.

eToro entered a partner utilizing publicly traded assets business deal with FinTech Acquisition Corp in March 2021. The move paved the way for eToro to diversify its trade portfolios while allowing other traders to invest in eToro directly.

Etoro launched its money wallet on its platform in November 2021. The eToro money wallet is available online and on mobile and allows users to open an account, complete with a Visa debit card. With this account, eToro clients can withdraw their profits at any time. This app also allows you to make payments using or withdrawals from anywhere in the world using your eToro Visa Debit card.

In January 2022, eToro USA LLC launched stock investments trading for its US-based users on its platform. This offering also allowed US users to own fractional shares in a particular stock while enjoying zero commission on the market spread. This new offering also allows US-based eToro users to trade in Exchange Traded Funds, commonly known as ETFs.

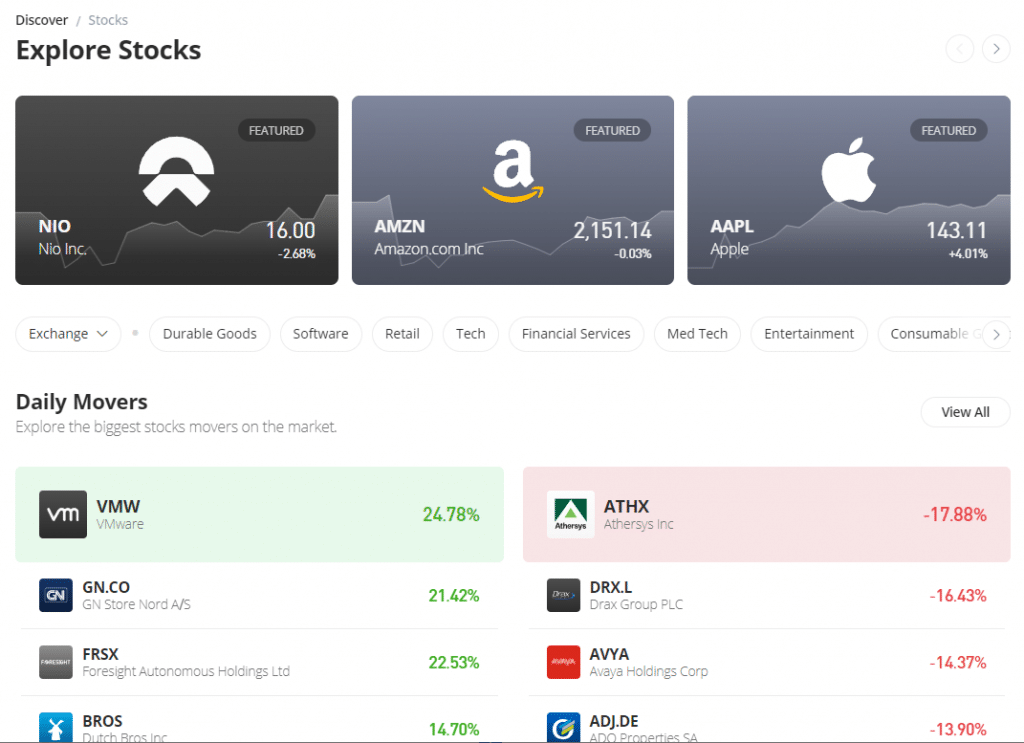

What Assets Does eToro Trade Offer Its Customers?

eToro users can trade in over 1,000 different assets. With so many options, it’s essential to know what makes each currency unique and how to trade them.

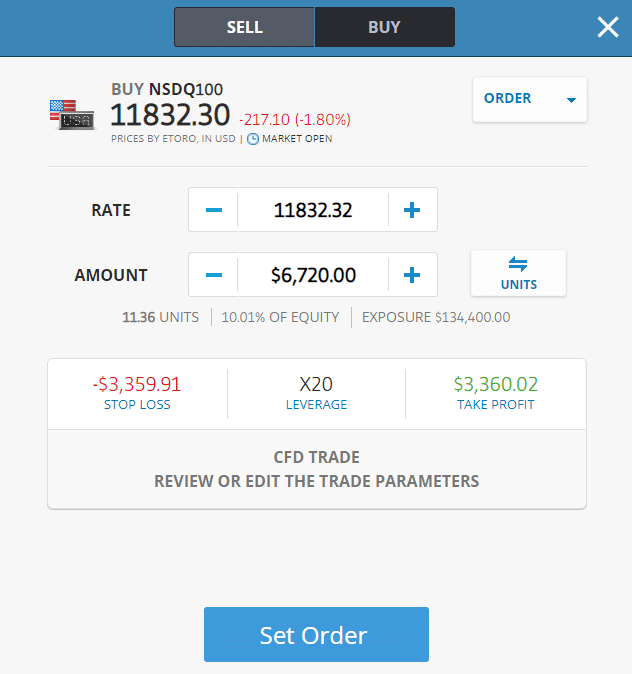

You can also trade with CFDs (contracts for difference), which means you don’t own the currency you are selling, but instead, you can speculate on its value. You can also use leverage, which is essentially borrowing money from the online broker to make a more significant investment than you can afford on your capital investment.

CFDs can be very profitable if the market moves favorably, but they can also lead to huge losses if things go wrong. However, it is critical to remember that trading CFDs can result in a loss of money on your account. You should never invest more than you can afford to lose because the market is unpredictable, and there’s always a chance that you might lose money while trading on the eToro platform.

Cryptocurrency trading

The eToro platform offers access to over 200 cryptocurrencies. These crypto-assets include Bitcoin (BTC), Ethereum (ETH), XRP, Litecoin (LTC), Bitcoin Cash (BCH), Cardano (ADA), Stellar Lumens (XLM), EOS, TRON (TRX), NEO, Dash (DASH), Monero (XMR), ZCash (ZEC) and many more.

eToro cryptocurrency trading offers and other complex instruments are sold directly through eToro’s website rather than through third-party online brokers or dealers like Merrill Lynch or Interactive Brokers LLC, who would charge commissions on your account.

As a beginner trader, it is important to understand the concept of the bid-ask spread before you start trading on a cryptocurrency exchange. The bid-ask spread is simply the difference between the highest price someone is willing to pay for a crypto asset and the lowest price someone is willing to sell a crypto asset. When you place an order on a cryptocurrency exchange, you will always be charged taker fees or market maker brokers fees. This fee depends on whether your order matches existing buy or sell orders on the exchange.

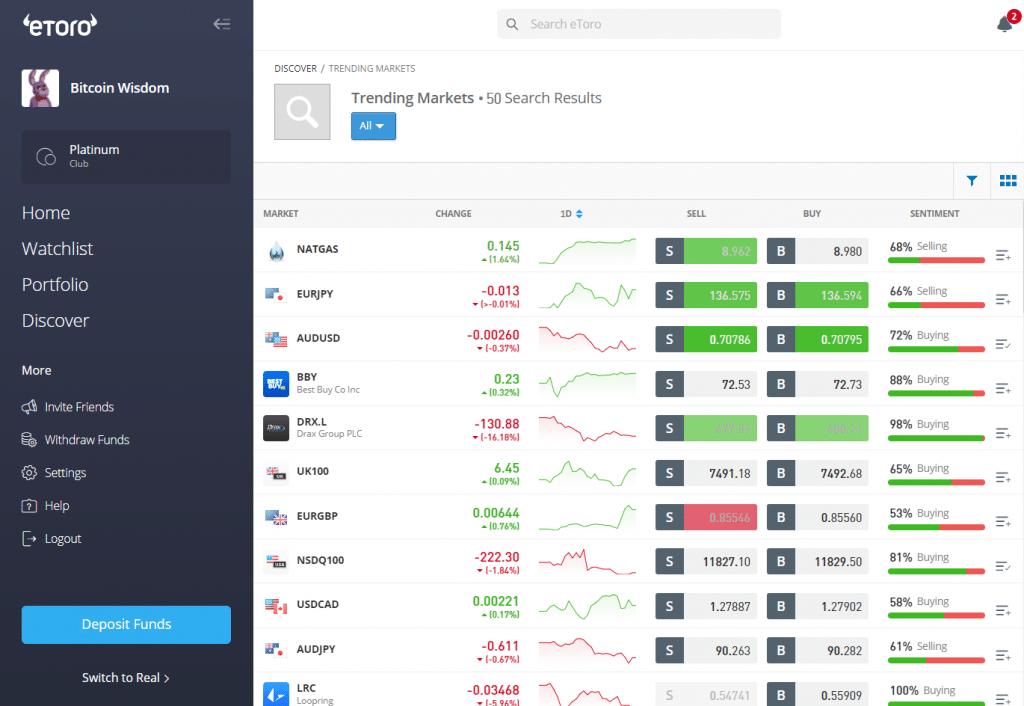

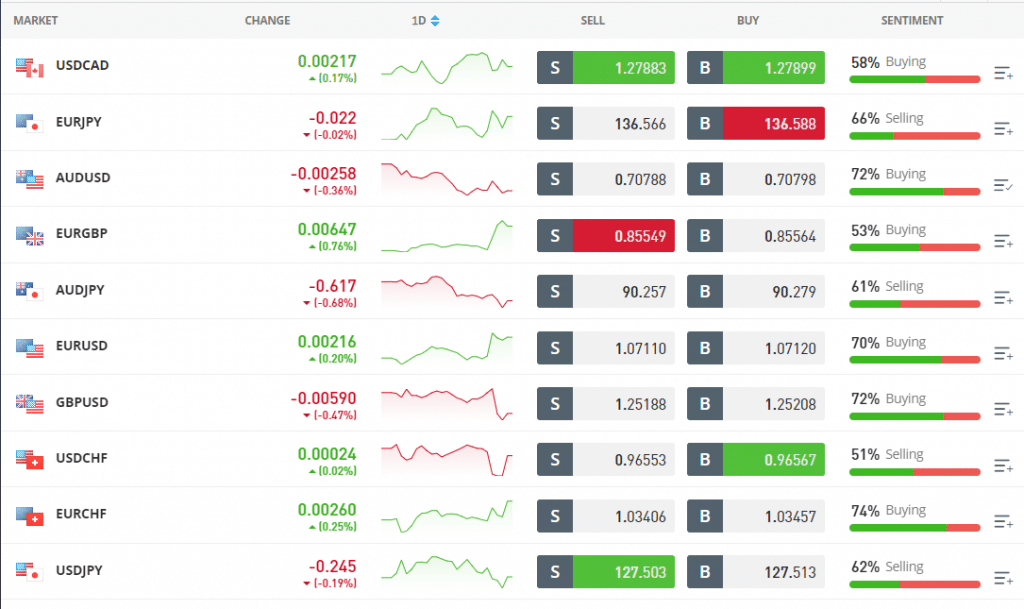

Forex Trading

Trading in forex involves buying one currency and simultaneously selling another currency at a specific price at any given time. You can trade in different currencies against each other (for example, USD/EUR), which means that if your trade goes up or down, then both currencies move with each other.

You can trade in the following currency pairs on eToro:

- AUD/USD

- EUR/GBP

- EUR/JPY

- EUR/USD

- GBP/CAD

- GBP/JPY

- GBP/USD

- NZD/USD

- USD/CAD

- USD/CHF

- USD/JPY

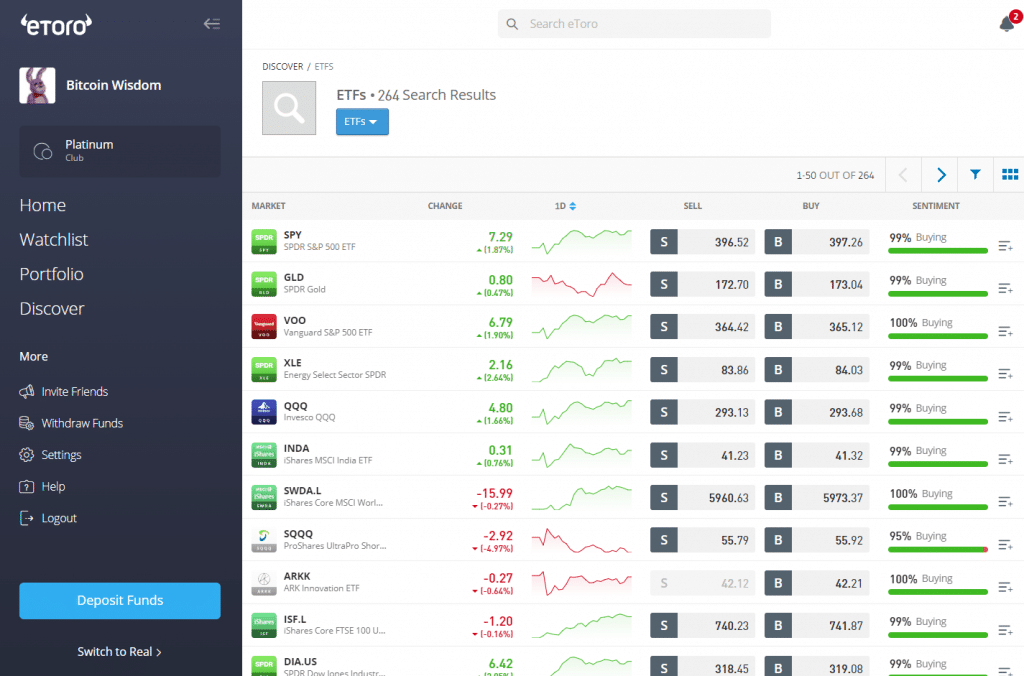

Exchange Traded Funds (ETFs)

Exchange-traded funds (ETFs) are a type of fund that trades on an exchange like stocks. They’re similar to mutual funds, but they don’t have any middlemen, which means you can change them during the day, just like stocks.

An ETF is an investment fund that tracks a combination of assets such as stocks, bonds, or commodities. Unlike mutual funds, which are usually under the management of an individual or team of professional forex brokers, ETFs track an index or a group of assets that moves together.

Because they’re passively managed, ETFs tend to have lower fees than mutual funds. ETFs track the performance of an underlying index, like the S&P 500 or NASDAQ 100. You can buy and sell ETFs on your eToro account just like you would company stocks or other securities. You can use eToro’s tools to analyze the market and decide what ETFs might be best for your portfolio.

You can trade ETFs on eToro in two ways directly via your brokerage services account or indirectly by purchasing CFDs on an ETF’s price movements.

How To Trade ETFs On eToro

It’s easy to trade ETFs on eToro. Here’s how:

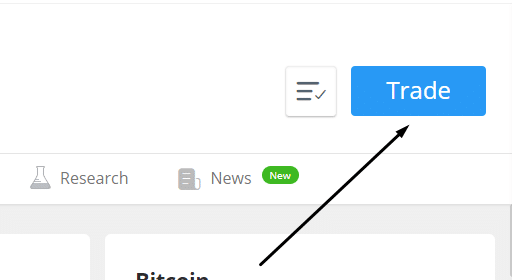

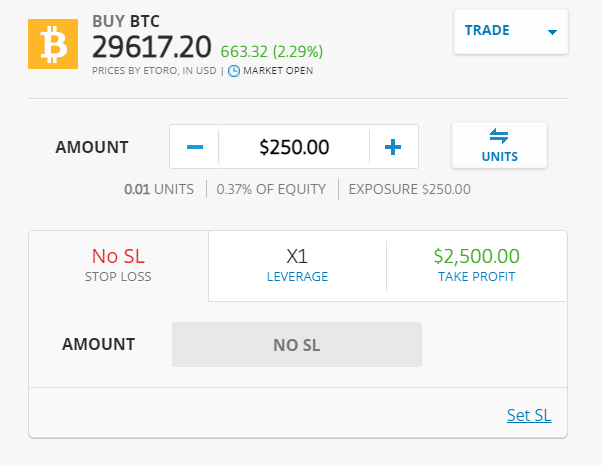

1. Click the “Trade” button in the top left corner of your screen.

2. Choose an instrument from the drop-down menu, in our case BTC.

3. Click “Open Trade.”

4. Type your order details: instrument, quantity, price per unit, etcetera.

Stocks and commodities

Stocks are shares in a company that gives you partial ownership of the company. When you own a stock, you’re entitled to a share of its profits. For example, if you buy 100 shares of stock in Microsoft, you become a part-owner of the company. You can purchase stocks in companies like Apple or Facebook on the eToro platform.

You’ll receive a dividend every quarter or so depending on the company’s earnings, and when the company sells out, you will likely get some money back. You can also sell your shares to other investors or online brokers.

Commodities are raw materials used for various products. Some examples include oil, gold, silver, corn, and soybeans. Commodities can also be things like crops or livestock raised for food production. The price of these items fluctuates with supply and demand just like stocks do because they’re not in control of just one company but are traded on open markets worldwide!

Why Trade Stocks And Commodities On eToro?

Stock prices rise and fall based on supply and demand, which means they’re subject to change based on factors outside of their control. This volatility makes them great for trading, and you can make money off of stocks by buying low when they’re low (when there’s a lot of supply) and selling high when they go up (when there’s less supply).

Stocks and commodities are the most popular financial instruments to trade on eToro. They are ideal for beginners, as they are simple to understand, but they also allow you to make a lot of money. You can trade stocks and commodities on eToro. You can open a trading account with eToro and start trading stocks when you’re ready.

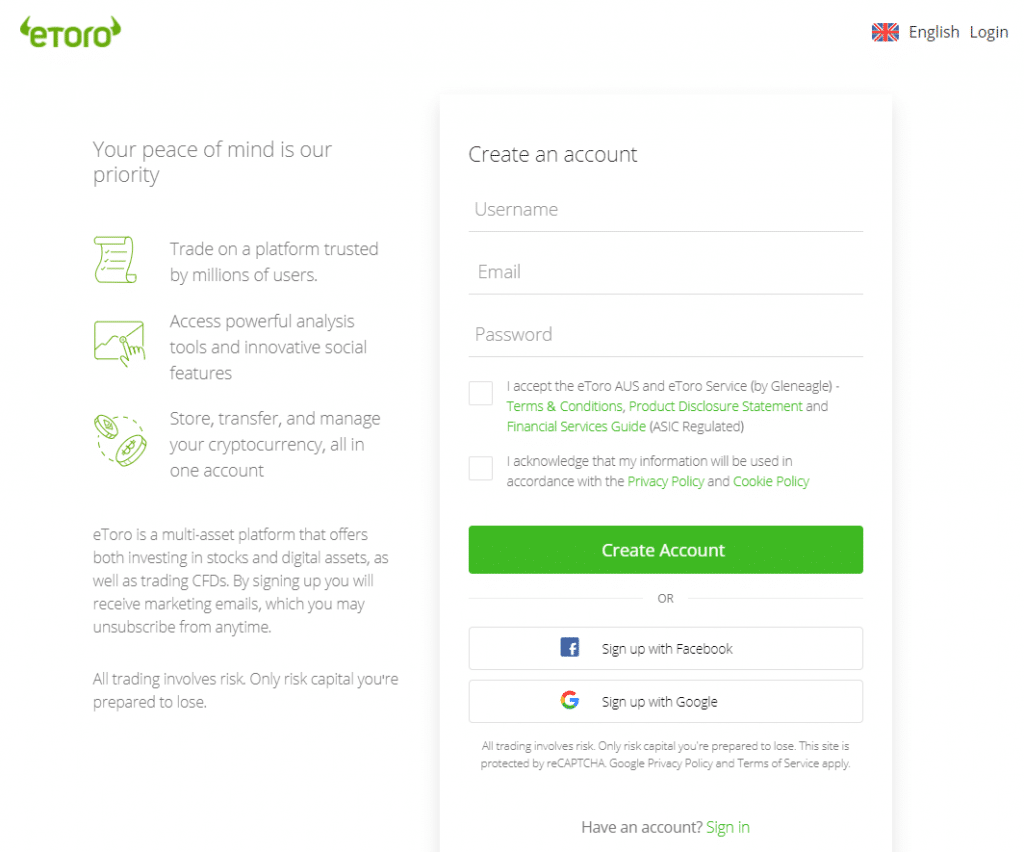

How Can I Open An Account On eToro?

If you’re looking to get started with eToro, it is essential that you first learn about the available types of accounts. The type of account you choose will determine the amount of money you can trade with and your access to features like CopyTrader and live streaming market commentary.

You can open any eToro account using your Facebook or Google+ login credentials. However, if you want to use more advanced features like CopyTrader or live streaming market commentary, you’d instead open an eToro Live account.

eToro offers three different account types: basic, standard, and premium. The basic account is completely free to open and use. However, the standard and premium accounts have some features only available on those accounts.

The basic account is limited in the amount of money you can trade with and the number of available assets for trading. This account works if you’re just getting started investing or want to try things out before committing more money to the market.

The standard account requires a minimum deposit of $200 but allows for more investment options than the basic version. You still won’t be able to invest as much as you could in other brokerages or funds; however, this option might be best for someone who wants more control over their investments and doesn’t want them managed by others (or by algorithms).

The premium account requires a minimum deposit of $2,000 but allows for even more investment options to allow you room to diversify your investments. eToro also operates eToro Club, a VIP account club for long-term investment members who maintain balances between $5,000 and $250,000.

How Can I Select A Trade On eToro?

Once you’ve signed up for an account, you’ll be able to see the different financial instruments available for trading on eToro. These include stocks, currencies, commodities, indices, ETFs, and CFDs (contracts for difference). You can also choose between manual or automatic trading options based on your preferences.

Manual traders have complete control over their investments because they set their stop-loss limits and take profit targets before entering into any trade agreement with another investor on the platform.

Automatic traders are more like robots who use algorithms to execute trades at predetermined prices and time intervals specified by traders themselves within pre-defined parameters such as risk tolerance levels etc.

How Can I Place A Trade On eToro?

The process for placing trades on eToro is simple once you know what asset to trade. To place a trade:

- Click the “Trade” button at the top of your screen. A trading dashboard appears on your screen where you can view all of your current positions and open orders.

- Select which asset type you would like to trade from the left sidebar menu. The left sidebar menu has tabs for each asset class eToro offers, including stocks, crypto assets, commodities, bonds, and currencies.

- Choose which instrument or currency pair you would like to buy or sell from the drop-down menus under each asset tab.

- Enter an order size and price for your selected instrument or currency pair by entering values into their respective fields at the bottom.

How Can I Copy A Trade Or Portfolio On eToro?

You can copy a trade or portfolio on eToro by following these steps.

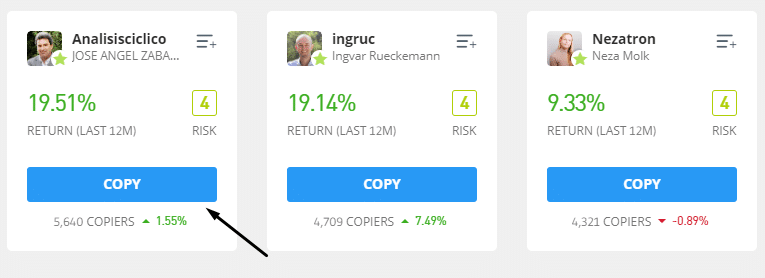

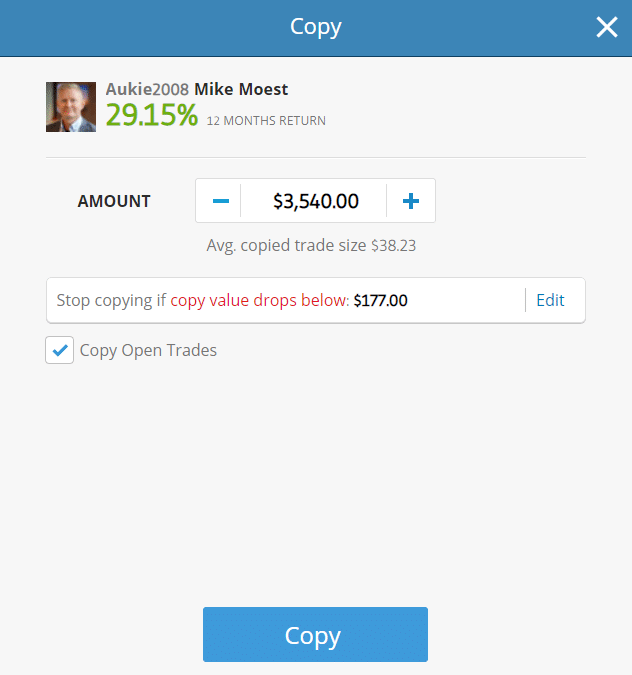

- Find the trader you want to copy. You can do this by searching for their name or looking at traders who have their trading history presented on their portfolios. The traders with the most followers are generally the ones who have been trading for a long time and have a successful track record.

- Click on the icon that says “Copy” above the trader’s name, which will open up a menu with more options for copying that person’s trades and portfolios.

- Select which of those options you want to copy. For example, if you’re going to copy their entire portfolio, select “All.” Select “One Specific Trade” if you wish to imitate one particular trade, like “One Specific Trade.”

Once you have successfully copied a trade, you’ll be able to see how much money the other traders are making every day or week!

How Much Does eToro Charge Customers On Their Platform?

As mentioned earlier in this article, eToro does not charge any fees to open or manage an account. The zero charges also apply to account management even when copying other users’ trades or portfolios. eToro also charges zero commission on your stock trade markups, stamp duty, or market spread transactions.

Withdrawal fees

eToro charges a $5 fixed withdrawal fee. The minimum amount you can withdraw from your eToro account is $30.

Spread fees

A spread fee is a charge for the difference between a selling price and a buying price. When you buy an asset at a low cost, then sell it at a profit, eToro attaches a small trading charge on that market spread. The spread fee affects all types of assets or instruments available for trade on eToro.

Overnight fees

eToro charges an overnight fee on any CFD transaction or position you hold for over 24 hours. This overnight fee is also commonly known as a rollover fee and is only on CFD transactions. If you reserve a CFD position over the weekend, you will be charged a weekend fee on your account.

Currency conversion fees

eToro trades in US dollars, and as such, you must convert your investments or profits to or from US dollars when depositing or withdrawing on the platform. This charge depends on your transacting amount and starts at 50 basis points.

Transfer fees

eToro charges you when you transfer your crypto assets from your account to eToro Money’s crypto wallet for further transactions. This charge depends on the cryptocurrency you are moving.

Account inactivity fee

eToro charges you a $10 fee every month when you don’t trade or leave your account inactive for more than one year.

Can I Lose Money On My eToro Account?

Yes, you can lose money on your account on eToro. eToro review indicates that about 76% of eToro accounts can lose money due to misinformation when trading CFDs and other asset types on the eToro platform. Some of the reasons you might be losing money rapidly in your eToro account include:

- Many eToro retail investor accounts lose money because they fail to implement important trading strategies, like diversifying their portfolio options or enabling the take-profit and stop-loss options.

- Another reason most retail investor accounts lose money on eToro accounts is because they don’t understand how to use leverage effectively. Leverage is when you borrow money from the broker to trade with on your account. This leverage helps you diversify your portfolio and comes with a high risk of losing money. Follow eToro’s investment advice before jumping into this trading strategy.

- By default, eToro operates fully automated features to find crypto trading ideas and match them to your trade. However, you can turn off this feature if you choose to place manual trades instead to avoid losing money rapidly. If you choose to place manual trades, then eToro will not execute any orders for you unless you explicitly tell it to do so by clicking on the “Buy” or “Sell” button on your account dashboard.

How Secure Is My Investment Account On eToro?

When you open a trading account on eToro, you can rest assured your funds are in safe hands. eToro holds its customer’s funds in a separate, segregated account from its company account. This segregation ensures your funds are secure even if eToro goes bankrupt. eToro also utilizes cold storage on all cryptocurrency trades and accounts. This type of storage ensures your digital assets are safe from withdrawal if your account gets hacked.

International Standard Regulations

The eToro platform is regulated by the Financial Conduct Authority (FCA) in the UK and CySEC in Cyprus.

The FCA regulates all investment companies operating in the UK, including eToro UK and eToro Europe. In addition to monitoring the company’s compliance with the EU regulatory framework on financial services and any potential breaches of conduct, the FCA also ensures that customers can access their money safely and easily.

In Cyprus, eToro is regulated by the CySEC (Cyprus Securities and Exchange Commission). The Financial Industry Regulatory Authority (FINRA) regulates eToro USA LLC operations. At the same time, the Australian Securities and Investments Commission (ASIC) is the regulatory body that oversees eToro Aus Capital Pty, eToro’s subsidiary in Australia.

eToro insurance cover

eToro offers all its users an automatic and free insurance cover for their investments. Lloyds of London provides this free insurance. eToro UK Limited also has a financial services compensation scheme for its UK customers.

Multi-Layer SSL data encryption and password protection

In addition to being regulated by these international financial regulatory bodies, eToro also uses Secure Sockets Layer (SSL) encryption to protect your account information when you log into your eToro account. This extra layer of protection helps ensure that no one can access your personal information without knowing your login credentials.

Two-factor authentication (2FA)

eToro uses two-factor authentication (2FA) to keep your account secure. Two-factor authentication requires you to input both an email address and a password or authorization to access your account on any device. This authentication also means that even if someone gets their hands on your password, they won’t be able to log in unless they have access to one of the devices linked with your account.

What Are The Advantages Of Trading On eToro?

There are many reasons why you can choose to trade on eToro instead of other platforms. Here are a few reasons for your consideration:

- You don’t need any trading experience or knowledge to use eToro. It’s an excellent way for beginners to get started in trading without worrying about losing all their savings!

- eToro offers a wide range of assets that you can trade with, including stocks, cryptocurrencies, commodities, and ETFs. You can even invest in specific company stocks directly through eToro.

- There’s no limit on how much money you can spend either, so if you have $100 or $100 million, there’s something here for everyone!

- As a trader, you can copy or follow the trades of other investors or set up your automated trading strategy. When you follow someone on eToro’s platform, you’ll see that person’s transactions in real-time. You can then decide if you want to mimic their trades or not.

- eToro has an internal social network where traders can discuss different topics related to trading and share ideas with each other. The social aspect helps create a sense of community among members while also learning from one another’s experiences.

- The eToro platform is available in many different languages, including English, Spanish, French, German, Italian, and Portuguese. This platform is accessible on desktops and any mobile device.

- The platform offers good educational tools as well. It has videos that explain how to do various things on the site, like opening an account or placing trades. eToro also has a library of articles on various trading topics. These articles can help you make better decisions when choosing which stocks or other assets to buy or sell.

- eToro also offers an innovative platform that is easy to use and provides a wide range of features, including news feeds, charts, and technical analysis tools.

What Are The Disadvantages Of Trading On eToro?

Trading on eToro has a few disadvantages, which include:

You can only trade in US dollars. Being a one currency base forces users from other countries to incur extra charges when they convert their respective currencies to US dollars so they can trade or invest on eToro.

eToro charges higher non-trading fees compared to other trading platforms. These non-trading charges include withdrawal, inactivity, and transfer fees.

eToro’s Customer Service

eToro receives a lot of praise from users for its user-friendly interface and its social features that allow you to copy other traders’ strategies. eToro’s customer service is available 24/7 via email and phone. The company also has an extensive FAQ page on its website that answers many customer queries.

eToro network has an overall rating of 4.1 stars out of 5 on Trustpilot, with 15% of reviewers giving it a 1-star rating and 6% giving it a 5-star rating.

How Does eToro Compare To Other Trading Platforms?

The trading fees on eToro are lower than those on other platforms, which makes it easier for investors to keep more of their profits. In addition, eToro gives users the ability to use leverage when trading with crypto assets using a CFD contract.

It’s also worth noting that eToro is one of only a few platforms in the market that lets individuals trade with each other using virtual money, not just real currency. So if you want to trade with someone who has more experience than you or earn more money by teaching others what you know, this might be an excellent option for you!

Conclusion

Overall, eToro is a solid trading platform. Whether you’re a new day trader or an old-timer looking to try out some new features, the eToro platform provides exciting tools and investment flexibility.

It takes a lot of hard work and research to become proficient in this market, and eToro has done the hard part of the research for you, providing you with a portfolio of recommended trades. eToro is also easy to use and open to users from almost any country, making it an ideal choice for everyone. It’s certainly worth a look.

- 0% commission on shares & ETFs

- Social trading network

- Supports Copy Trading

- Trade crypto with low fees

- Useful demo account

- Regulated by CySEC

You have the possibility to lose money when trading CFDs with this provider. Only invest what you can afford to lose.