Overview

When you look at all the major cryptocurrency exchanges out there, it is clear that a lot of them offer several choices to trade cryptocurrencies. Several exchanges have over 100s currency pairs listed on the platform, which lets users easily buy and sell these cryptocurrencies.

However, there is a definite lack of crypto exchanges that can allow users to trade crypto derivatives on margin, and this is where FTX comes in. In this review, we shall discuss FTX, the features it offers, as well as the kind of traders that the platform is best suited for.

What is FTX Exchange?

Looking at the current state of the crypto industry, it is clear that when it comes to trading crypto tokens and cryptocurrencies, there are hundreds of exchanges out there that users can choose from based on their requirements.

We have analyzed several of these exchanges and reviewed their service offerings in the past, including eToro, Binance, Coinbase, as well as Kraken. However, FTX is an exchange that is quite different from all of these exchanges.

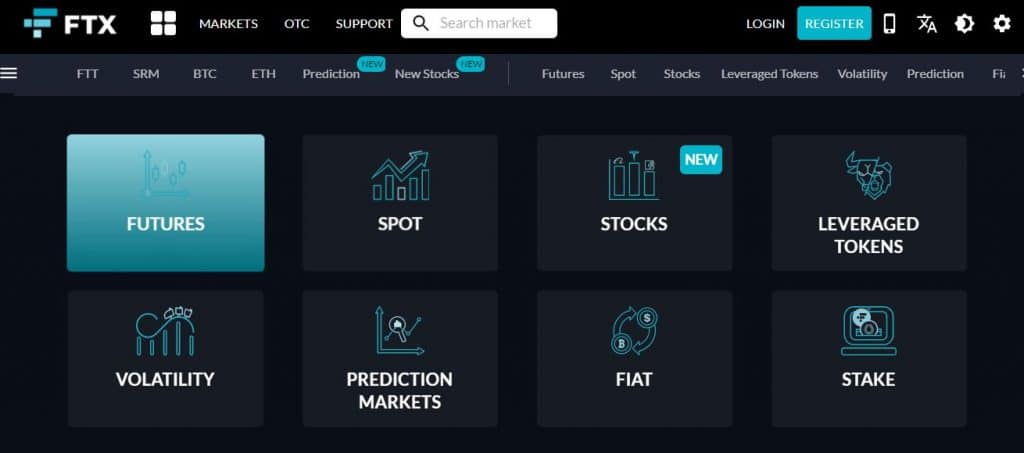

FTX Exchange is a centralized cryptocurrency exchange that is different from most of its competitors because it offers a completely new and innovative suite of products – for instance, through FTX, users have the option for derivatives trading, options trading, as well as the trading of leveraged tokens, and more.

While there are a few other exchanges that offer the possibility of trading such assets too, they are quite far and few between, which makes the FTX service offering all the more desirable. This unique suite of products is what has led FTX to become the largest crypto derivatives exchange in the world.

FTX Review – Pros

The FTX trading platform has several pros associated with it, which include:

Support for Margin and Futures Trading

As we mentioned earlier, one of the major reasons why people prefer trading through the FTX exchange is because it offers access to a variety of unique products and services.

One of these unique services is the option of futures trading alongside simply trading the spot markets.

Traders prefer to trade futures contracts over spot contracts because of one main reason: it allows them to trade on margin, only putting up a small fraction of the value of the contract, while still being exposed to the complete profitability of the contract.

For example, let us assume that you wish to buy a BTCUSDT futures contract worth $500,000. This would be the equivalent of around 16 BTCUSDT spot contracts, assuming a spot price of approximately $31,000.

If you were to try and buy these contracts on the spot market, then you will have to put up the entire $500,000 to acquire these contracts. This is a significant capital outlay and is money that most people might not have access to.

However, through futures, you can still have access to the same contract without having to make a large capital investment. Assuming a 10x leverage, you will only have to put up $50,000 or 10% of the total contract value in order to buy the contract.

However, your profitability will remain the same and will be calculated on the basis of the contract value. Let us assume that the price of the BTCUSDT asset goes up by 10%, and the value of the contract is now $550,000. This means that you have made a profit of $50,000.

If you had bought the spot contract, then you would only make a profit of $50,000 on a $500,000 investment, which is a 10% profit. However, in a futures contract, you will end up making a $50,000 profit on a $50,000 initial investment, which is a 100% gain.

Therefore, the ability to trade futures on FTX using margin trading allows users to magnify their profits without having to invest a lot of capital into positions, which makes futures trading very attractive to experienced traders and investors.

Advanced Markets

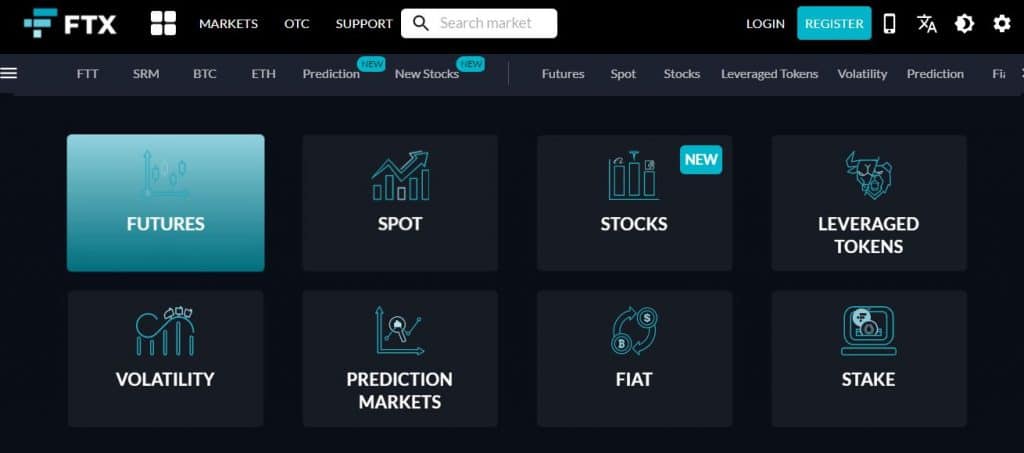

In the previous part, we discussed how FTX provides access to futures contracts and margin trading. However, this is not the extent of the platform’s features, and it also allows users to trade several other innovative products.

These include leveraged tokens which allow users to trade any asset on leverage, synths that allow traders to trade any asset including stocks and commodities without having to leave the blockchain world, as well as volatility tokens through which trades can profit from the volatility in the market.

Additionally, FTX users also have the option of trading forex pairs, stocks from all over the world, and almost any asset that they can think of. While each of these products also has its own set of risks associated with them, they can prove to be a lucrative avenue for advanced traders who understand the risks.

Low Trading Fees

Despite the fact that FTX is one of the most innovative exchanges and provides access to a number of unique products, its trading fees are actually quite competitive and are in line with the rest of the industry.

We shall be discussing this in detail below when we talk about the fee structure associated with trading different products on FTX, however, it is important to mention that it has one of the lowest fees associated with any other similar platform that provides access to a similar suite of products.

Global Availability

FTX is a crypto exchange that is available globally, which means that users from any part of the world can easily access the platform and trade the assets that are available.

This becomes a particularly useful feature especially when you consider the option of trading synthetic assets through the platform. Usually, trades outside the US cannot trade US stocks unless they go through a special broker who charges extremely high commissions due to the fact that they are offering a unique service.

However, through synthetic assets on FTX, any user located anywhere in the world can easily access any market they wish, all while remaining in the crypto ecosystem and not leaving FTX at all. This further strengthens the pillar of accessibility, which is a building block of the DeFi world.

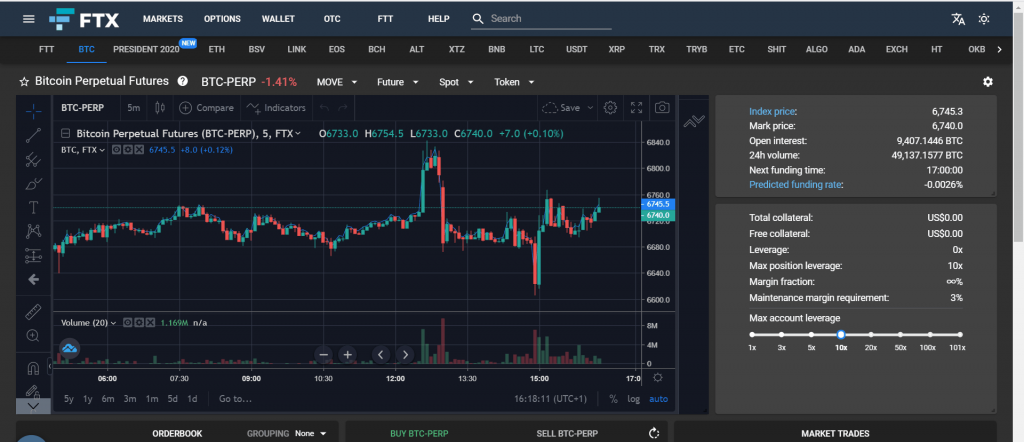

Advanced Charting Tools

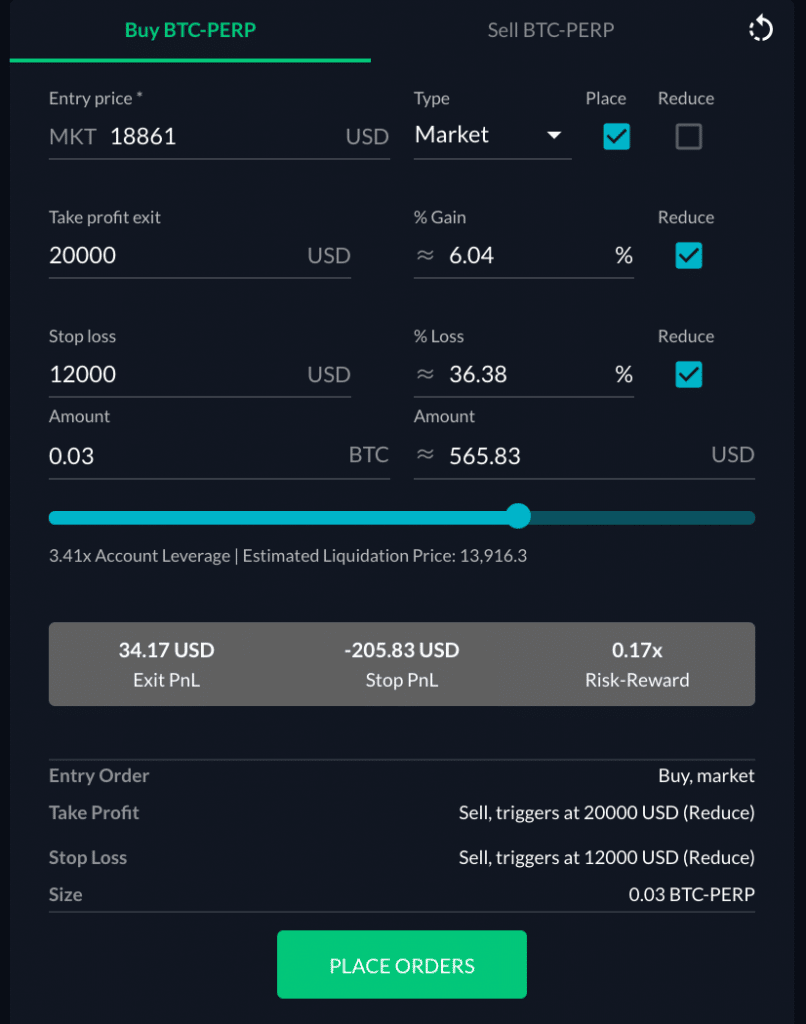

As we discussed earlier, the different products that users can trade on FTX come with their own set of risks and volatilities, and therefore, they are only suitable for advanced traders.

This means that whenever advanced traders are trading these products, they have to be extremely careful and mindful of the structure of the products and the different profitabilities associated with them.

In order to support this, FTX offers users several advanced charting and trading tools which make it possible for users to trade as they wish and make more informed trading decisions.

The advanced trading options offered by FTX are virtually unmatched in the industry and are a major part of the reason why the platform is so highly preferred among experienced traders.

High Liquidity

Because some of the products offered by the FTX exchange are unique to it, this might cause some users to wonder whether these products still have a high enough level of liquidity that would make them worth trading.

When it comes to trading derivative contracts, liquidity is often a major concern since it determines whether or not the trader will be able to sell the token whenever they wish to do so.

However, with FTX, the exchange has structured its algorithm in such a way that it always enjoys a high degree of liquidity, which makes it a very attractive avenue for advanced crypto traders who might want to trade complicated products that do not always have a very large market associated with them.

FTX Review – Cons

Every coin has two sides, and the FTX trading platform is no exception. There are several cons associated with the platform, which include:

Limited Offerings in Some Countries

We mentioned earlier in this review that FTX has a very large variety of products that users can trade through the platform, but there is a catch here: in some regions of the world, the service offerings might be limited.

For example, due to the regulations in the crypto space that have been imposed by the US government, the FTX US offering is quite limited in comparison to the rest of the world.

FTX US functions through a completely separate exchange called FTX.US, and its offerings are highly limited. For example, some of the riskier products and derivatives cannot be accessed and traded through the FTX US exchange.

Poor Customer Support

Another disadvantage associated with the FTX platform is that it has very poor customer service, which is often known for being unresponsive and unhelpful.

For example, the exchange does not offer any live chat support to its users, which can be quite inconvenient whenever users are facing problems and would like to get their queries resolved.

The FTX exchange help center is quite exhaustive and contains answers to all the common questions that traders might have, however, it is not very well organized, and traders have often reported that it takes them a very long time to find what they are looking for on the platform.

Considering the fact that the FTX platform is quite complex and offers structured products, the fact that it does not have a good and reliable customer service helpline like phone support or a live chat can be a problem for many traders. The complex nature of the products being traded through the exchange means that if traders make mistakes, they can stand to lose huge amounts of money.

Not Suitable for Beginners

As we discussed earlier, the FTX exchange is not very suitable for newer investors or traders. This is true for a variety of reasons.

For starters, newer users usually trade just in the spot market, and if this is the case, then there are several other exchanges that they can opt for which allow them to trade spot markets with a lot more assets and lower fees. Therefore, it is quite unlikely that a trader will opt for FTX if they are only planning on trading spot products.

In addition to this, trading most of the complex products requires investors to have a keen understanding of the product, its risk profile, and the crypto market as a whole. This is not something that beginners are likely to have, therefore, they will not be able to get the most out of the FTX service offerings.

Lastly, the interface of the platform itself can serve as a form of discouragement for beginners. The platform has a lot of advanced trading features and tools, which might be quite intimidating to beginners. It also does not have a simpler version that newer traders can use in order to get familiar with the market.

FTX – Cryptocurrencies Available

FTX is a relatively new crypto exchange when compared to some of the other major crypto exchanges, however, it offers a very vast variety of cryptocurrencies that users can choose from.

For starters, in order to get started with trading on FTX, most users deposit fiat currencies onto the platform. FTX supports deposits and withdrawals in a variety of fiat currencies, including:

- USD

- EUR

- GBP

- AUD

- CAD

- CHF

- HKD

- SGD

- ZAR

FTX also allows users access to a variety of unique altcoin indices, Bitcoin options, MOVE contracts, and spot trading.

Some of the major cryptocurrencies that can be traded through FTX include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Binance Coin (BNB)

- Tether (USDT)

- FTX Token (FTT)

- Bitcoin Cash (BCH)

- XRP

- Tezos (XTZ)

- ChainLink (LINK)

- EOS

- Ethereum Classic (ETC)

- PAX Gold (PAXG)

- Huobi Token (HT)

- Tron (TRX)

- Dogecoin (DOGE)

- UNUS SED LEO (LEO)

- Bitcoin Satoshi’s Vision (BSV)

- BitMax Token (BTMX)

- Cardano (ADA)

- Algorand (ALGO)

- TomoChain (TOMO)

- OKB

- BiLira (TRYB)

- MATIC

- Cosmos (ATOM)

FTX – Platform Fees

Any trading platform charges two types of fees: trading fees and non-trading fees.

FTX Trading Fees

Trading fees refer to the fees that users pay in order to place orders on the platform and have them executed. Most cryptocurrency exchanges charge trading fees in one of two ways: they either charge spreads or commissions.

Spreads

Spreads refer to the difference between the bid price and the ask price. This model is primarily adopted by market-maker trading platforms that assume the position of the counterparty in the trade. Therefore, you are effectively trading against the platform.

When this happens, there is usually a difference between the price at which you can buy the asset and the price at which the asset can be sold at any given moment. The buying price, also called the bid price, is almost always higher, and the difference between these two prices is called a spread.

What this effectively means is that if you were to buy and sell an asset at the same time, you would actually incur a loss.

Commissions

The other form of trading fee that might be charged by an exchange is a flat commission on every trade that you make. This is usually a very small percentage of the trading volume and is done in a decreasing manner, i.e. the higher your trading volume, the lower the fees that you will have to pay in this regard.

FTX Fee Structure

FTX primarily charges trading fees in the form of commissions that you pay for every successful trade.

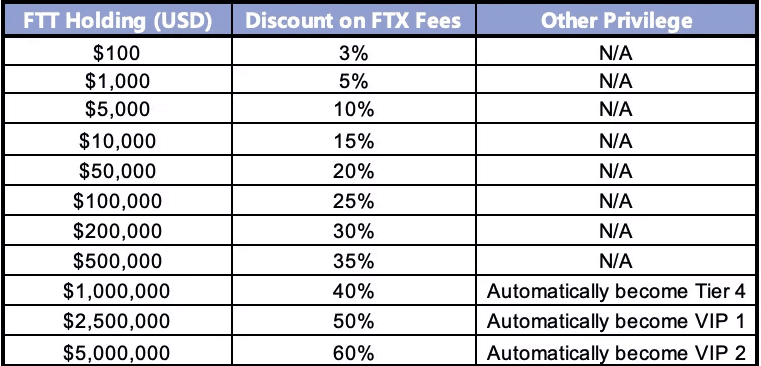

However, the extent of the commissions charged can differ greatly. For example, if you were to trade through the platform’s native token, which is the FTT token, you would be able to get a discount on the fees that you pay. In some cases, the discount you get can even be as high as 60%.

Additionally, your trading volume directly determines your fees, which means that the more you trade, the lower the commissions that will be charged on your trades.

Another important point to consider when it comes to the fees that FTX charges are that it employs a maker/taker fee structure. Here’s what that means:

Orders that add liquidity to the market are called maker orders and are charged a lower fee.

Orders that take away liquidity from the market are called taker orders and are charged higher fees.

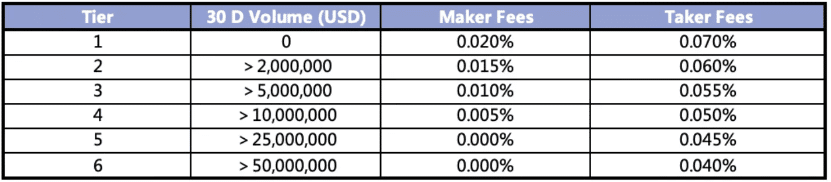

The trading fees based on your 30-day volume are shown in the table below:

The discounts that you can get simply by having an allocation of the FTT token are quite large, and have been listed below:

FTX Non-Trading Fees

In addition to the trading fee, cryptocurrency platforms often also charge a variety of other incidental fees and charges. These have been discussed in detail below.

Deposit Fees

Most cryptocurrency exchanges charge fees in order to allow users to deposit money into their accounts.

On FTX, there are no charges associated with depositing funds to your FTX account if you choose to do so through a bank transfer or an ACH transfer.

On the other hand, if you choose to add funds to your account using debit or credit cards, then you will end up paying a deposit fee of $0.30 and 0.29% of your transaction value.

There are no charges for adding cryptocurrencies to your account, and the only fees that you will end up paying are the network fees associated with the deposit.

Withdrawal Fees

Similar to deposit fees, most cryptocurrency exchanges also charge fees if you wish to withdraw money out of the platform. When you wish to withdraw money from your FTX account, there are withdrawal charges associated with it, depending on the method of withdrawal you choose.

On FTX, there are no charges associated with withdrawing funds from your FTX account if you choose to do so through a bank transfer or an ACH transfer.

On the other hand, if you choose to withdraw funds from your account using debit or credit cards, then you will end up paying a withdrawal fee of $0.30 and 0.29% of your transaction value.

There are no charges for withdrawing cryptocurrencies from your account, and the only fees that you will end up paying are the network fees associated with the deposit.

FTX Review – Platform Features

There are several features and options that the FTX exchange offers for traders and investors. These have been discussed below in detail.

Fiat Currency Transfers

One of the most attractive features of the FTX exchange is that it allows users to buy cryptocurrencies directly through fiat transfers.

As we discussed earlier, the exchange supports a variety of fiat currencies in this regard, including USD, EUR, CAD, GBP, as well as AUD.

Users can also deposit funds into their FTX accounts using their credit cards.

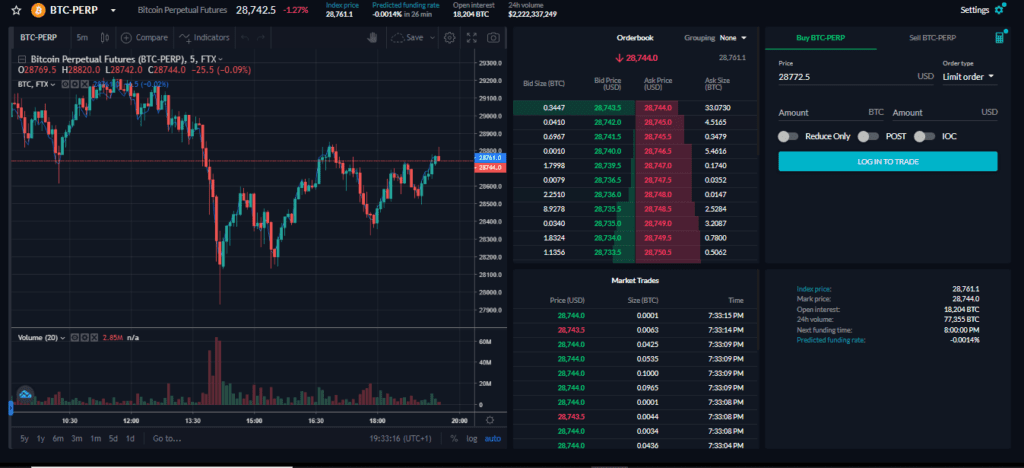

High Leverage

Another very attractive feature that FTX offers to advanced traders is the ability to trade on very high leverage, which is well beyond what most other crypto trading platforms offer at present.

For example, on FTX, the maximum leverage that a user can utilize on trades is 101x, which allows them to really maximize their profit potential and make larger trades without risking a lot of capital.

This leverage, however, is only provided to advanced users once FTX verifies that they are aware of the risks associated with using such high leverage.

Easy Settlements

FTX provides users with the opportunity for easy settlements, as users can trade all the products that FTX offers through just one margin account.

In most exchanges, isolated margin accounts are used, wherein users have to maintain separate margin accounts for each trade. This is quite inconvenient, especially for users that maintain multiple margin positions simultaneously since it means that they have to constantly monitor the margin levels in their accounts to avoid liquidation.

However, FTX uses a cross margin account for margin trading, which means that users can open multiple trades across assets and products through one single account.

Institutional Trading Features

For institutional traders who wish to trade derivatives and other complex products through FTX, there are a variety of features that can assist them in doing so.

For example, FTX provides deep liquidity and access to order books so that users can easily trade the derivatives products that they require.

Additionally, institutional accounts also enjoy the option of unlimited withdrawals and a liquidation desk.

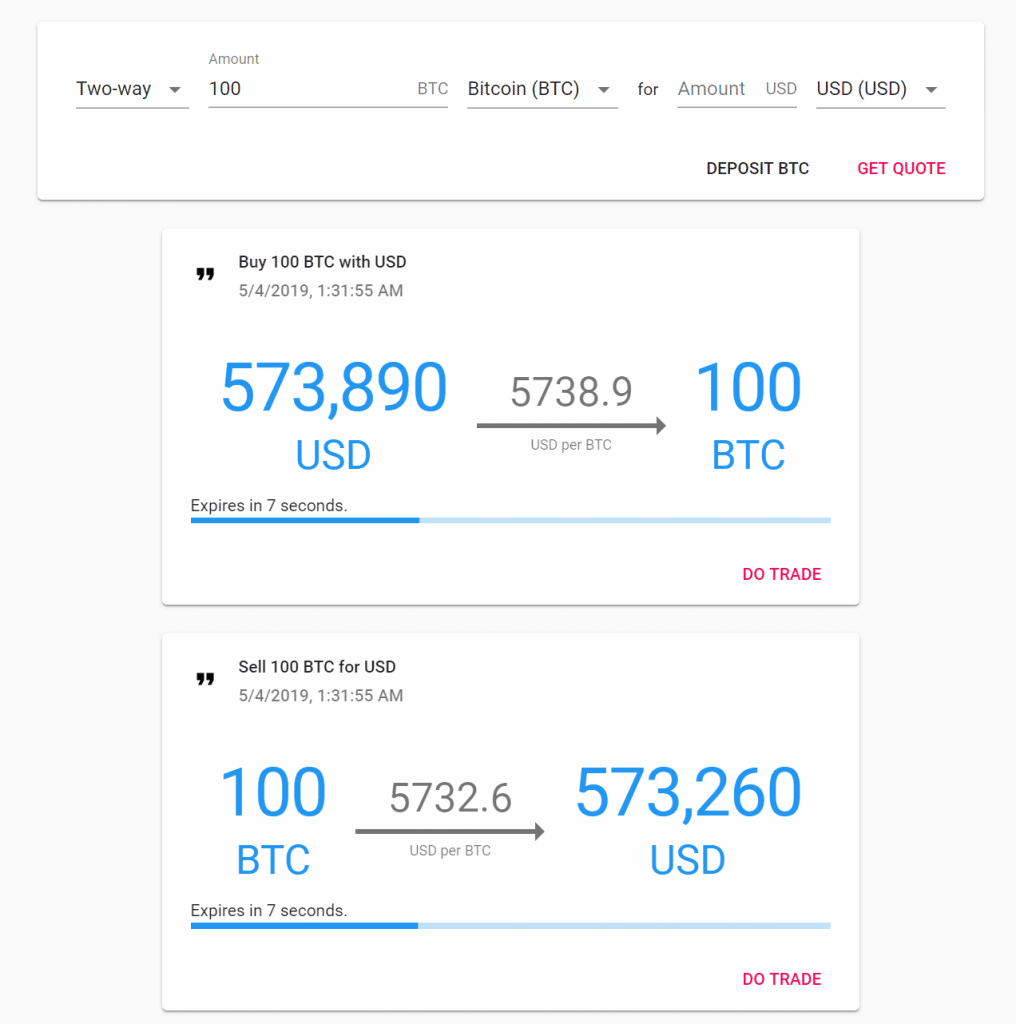

Lastly, for much larger orders that might cause a major movement in the market and therefore skew the price that the trader might pay for that trade, FTX also offers an OTC desk that can provide live quotes and allow traders to make large trades at competitive rates.

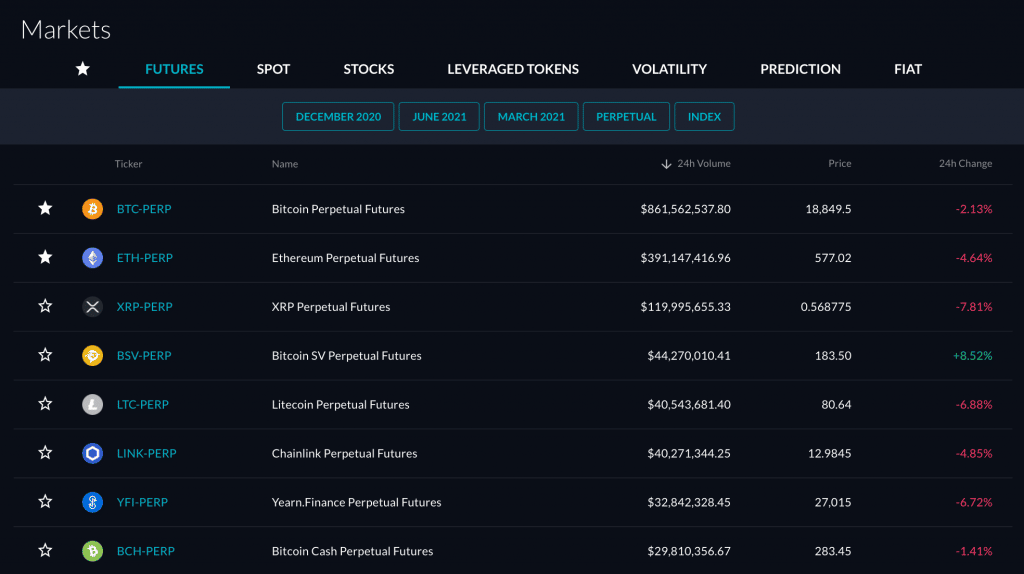

FTX Futures

FTX allows users the option of trading both quarterly and perpetual futures based on their requirements and their outlook on the asset.

These futures are available on over 20 popular cryptocurrencies including BTC, ETH, BNB, as well as LINK.

In addition to this, users can also trade Index Futures through the platform, thereby valuing entire collections of cryptocurrencies more easily and without complicated trades.

For example, some of the Index Futures that users can trade through the FTX Futures Trading platform include large-cap coins, mid-cap coins, and small-cap coins. Users also have the option of trading exchange e=tokens, privacy tokens, as well as regional baskets.

As an additional asset available to trade, users can even choose to trade futures on the WTI Oil asset.

FTX Leveraged Tokens

Another asset class that can be traded through FTX is the leveraged tokens asset class, which includes the ability to trade tokens with up to 101X leverage.

For all standard accounts, FTX places a default leverage limit of 20x as a safety precaution, however, users can increase this easily by going into the settings. The leverage can be increased to any point up to 101x as per the risk profile and the preferences of the trader.

The leveraged tokens provided by the platform present over 45 different assets and offer an easier way to get exposure to an asset. The reason leveraged tokens are preferred over standard tokens by most traders is that they rebalance every day automatically based on the movement of the asset during the day.

The BULL and BEAR leveraged tokens that are available for trading through the platform provide users with an easy and convenient way to go 3x long or 3x short on several digital assets. Some of these assets include BTC, ETH, LINK, XTZ, BNB, and XRP.

FTX MOVE

An innovative feature that is only offered by FTX is the ability to trade MOVE contracts, which are basically like future contracts except they are linked to the movement of the asset.

What this means is that they function as futures, however, their expiry is linked to the movement in the BTC spot asset over a certain period of time. This period could be daily, weekly, or quarterly, based on the specific contract chosen by the user.

MOVE contracts allow users to profit regardless of the direction in which the BTC prices are moving and simply trade on the volatility. The volatility associated with BTC over the lifetime of the MOVE contract is the main factor that determines its value.

FTX Options

FTX also offers users the possibility of trading options contracts that expire in USD.

Users can open call or put option positions, and these work in the same way as futures contracts, except they bestow the right but not the obligation upon users to buy/sell the asset.

Similar to futures, options trading on FTX can also be done using leverage.

FTX Prediction Markets

Prediction markets are a way for users to trade on events that usually have very little to do with the financial markets. FTX offers this possibility to traders as well.

For example, an example of a prediction market could be predicting who the next US president is going to be. The assets traded in these markets are like futures contracts, except they expire once the final result for the event has been confirmed, and the payouts are then made accordingly.

FTX – Safety Measures

FTX uses a variety of measures to ensure that the funds and the data that are present on the platform are secure and cannot be hacked or breached. Some of the main security features used by the platform have been listed below.

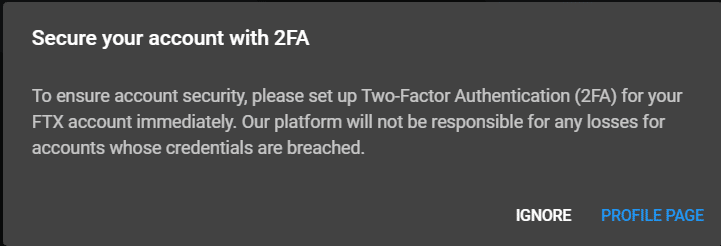

Two-Factor Authentication

FTX requires its users to complete a two-factor authentication process, either through the Google Authenticator app or through SMS before they are allowed to trade with FTX. The same process is also repeated for withdrawals from the platform.

This process is used to not only protect the user from unwanted interference, but also to secure credible information on the account, and can add an extra layer of protection to the exchange.

Withdrawal Locks

If a user makes any major changes to the account, such as the removal of two-factor authentication (2fa) or a change in the password, then FTX locks the account for 24 hours, not allowing any withdrawals until this period has passed.

Whitelisted Addresses

If a user wishes to withdraw funds into an external wallet, then this has to be a whitelisted wallet that is approved by the platform, this ensures that even if someone gets illegitimate access to an account, they cannot withdraw the funds from that account into their own account.

Third-Party Monitoring

Another major security measure that is used by FTX is the presence of external partners that can be used to monitor the activity on the platform and ensure that nothing suspicious is taking place.

For this purpose, FTX partners with Chainalysis which provides immediate alerts to the FTX security team in case they note another out of the ordinary that would raise red flags.

FTX Review – Final Verdict

FTX is a relatively newer exchange, however, in the span of merely three years, it has grown to become one of the most popular exchanges for trading derivative products.

The platform offers a variety of complex products such as leveraged tokens and MOVE futures that are not available on many other exchanges, and all this is provided along with low fees and high leverage, which makes for a very pleasant and seamless trading environment for experienced traders who understand the risks and know what they are doing.

However, at the same time, the platform has several disadvantages too. The fact that it is not suitable for newer investors due to its complexity alongside its limited US offerings and a lack of good customer support means that the platform is only suitable for highly experienced traders who are comfortable with the levels of risk that most products on the exchange present.

- Funds can be withdrawn 24 hours

- Support for Margin and Futures Trading

- Advanced Markets

- Low Fees

- Global Availability

- Fiat Currency Transfers

You have the possibility to lose money when trading CFDs with this provider. Only invest what you can afford to lose.