Where to Buy and Sell Bitcoin

Bitcoin has been here for more than a decade, and from the look of things, it is not going away soon. Over the years, cryptocurrency has been the cause of both good and bad news. Bitcoin has gone through different peaks through the years, and although cryptocurrencies are known for their volatility, investors have continued to join the platform.

This goes to show that Bitcoin has become more popular than ever. Currently, there are nearly 40,000 transactions that happen each day. However, it is not clear to some investors how to buy and sell bitcoin. There are also scammers and illegal services and exchanges online.

You need to have a digital wallet for you to be able to buy and sell cryptocurrency online. You will then have to link the online digital wallet to the website for exchange services you are interested in. Also, you can apply the use of your computer software for a digital wallet. You may store your digital wallet on a physical device such as a hard drive. This will ensure the wallet cannot be accessed through the computer without your authorization.

BTC to USD Price Today (Bitcoin) & Market Data

Bitcoin price today is $65,981.95, BTC price has moved 0.86% in the last 24 hours. The current market cap of Bitcoin is $1,301,892,522,897 with a 24 hour trading volume of $38,259,242,960.

Bitcoin to USD 24 Hour Chart

Bitcoin to USD 24 Hour Candlestick Chart

Buying and Selling Bitcoin

There are plenty of places you can buy and sell bitcoin online. The different platforms have their fair share of advantages and disadvantages. Security is an issue plaguing the buying and selling of cryptocurrency; hence we will look into some of the platforms with good reputations.

Another notable thing about exchanges is that some do not allow customers outside the United States. Additionally, some of the exchanges work with wire transfers only. Other exchanges may be okay with another type of exchange.

Another thing you should keep in mind is the fees involved in the different exchanges. The fees may primarily include transaction fees, deposit fees, Bitcoin network fees, and withdrawal fees. You will also incur buying limits and exchange rates.

Below are some of the places you can buy and sell bitcoin online.

eToro

This is the platform where you can buy and sell cryptocurrency. Primarily, the platform has been the go-to place to trade stocks. eToro hosts more than ten million users, providing numerous benefits for the investors.

Available to eToro users are leverage trading and social trading. It is a company established and regulated by the Financial Conduct Authority. The platform has low investor fees, and it encompasses different deposit methods.

The disadvantage of the site is you cannot use it if you are in Japan, Turkey, Israel, or Canada. The site only allows you to withdraw fiat currency after buying or selling Bitcoin. Flat currency is the usual currency that governments have accepted as legal tender. These include currencies such as the dollar or euro.

Below are some of the steps you can take to create an account on eToro:

- Visit Etoro, then click “Buy BTC” or “Join Now.”

- Submit personal data necessary for account opening.

- Fill in the form requested on the next page with the necessary information. Users can also log in via Facebook or Gmail.

- Click the button indicating “Sign Up” to submit the information.

- You will then need to submit Proof of Identity and Confirmation of Residence.

- You may also fill out a questionnaire based on your investing needs.

Coinbase

Our second choice for the best platform to buy and sell cryptocurrency is Coinbase. The platform hosts over 13 million users and is definitely one of the best trading platforms. The platform is secured, regulated, insured, accessible, and easy to use. It is a good platform for investors with different levels of knowledge.

The platform allows its users to trade fifteen crypto assets. Its fees are also fairly good and at par with the other exchanges. Some features have restrictions, but US, UK, and EU residents can use the platform without these restrictions.

Coinbase has a Pro version called Coinbase Pro; The fundamental difference is that the pro platform has a more sophisticated interface. Users on Coinbase pay higher fees than those on Coinbase pro since they enjoy the benefits of an easier interface. Regardless of the platform you use, all the trades will take place on the Coinbase Pro Engine.

Below are the steps you need to follow to create a Coinbase account.

- Go to coinbase.com. On the far top right of your screen, click “Get Started.”

- Provide your name, email, and password to create your account.

- You will receive a verification email and will be required to click “Verify Email Address.”

- Sign in to your account. You can sign in by re-entering your email and password before hitting “Sign in.”

- You will then use your number to set a two-step verification.

- A seven-digit code will be sent to your phone number; please enter it.

- Connect your bank to the account to be able to buy Bitcoin.

Binance

Binance is currently the world’s biggest crypto exchange regarding active trading volume. The platform has been operational since 2017. It is good for newbies because of its easy-to-use features and hosts over 13 million users. After setting up the account, you will be able to the settings to either Advanced or Basic levels depending on how familiar you are with cryptocurrency trading and investment.

The platform has been labeled the best trading option for traders outside of the US. However, there has been a clamping of its usage in some countries. The platform has run into problems with Italy, Germany, Japan, and Thailand authorities. On the other hand, Malaysia ordered the platform to seize operations in 2021.

The US is also laying pressure on the platform, just like all the other exchanges. The company asserted it paid the users all the losses they incurred. The platform hasn’t had any breaches besides the $40 million of Bitcoin value during 2019 nearly stolen.

Below are the steps you can follow to open a Binance account:

- Go to the platform’s webpage, then click on the “Register” button.

- Provide personal information needed to open an account. You have the option of using your mobile number or email.

- Create the credentials of the account on the page that follows.

- Enter the verification code that Binance sends to your phone or email.

- You can then use your debit card or credit card to pay for cryptocurrency assets. The platform also allows peer-to-peer trading.

- Proof of identity and Confirmation of Residence are requisites.

- New users fill out questionnaires that will aid in their investing goals.

Kraken

The platform has been reliable for a long time on matters of Bitcoin exchange. Kraken was created in 2011 and trades with both cryptocurrency and fiat currency. It is easy to navigate the platform. It also has many options that cater to different individuals, from businesses looking to add cryptocurrency into their payments to novices and seasoned traders.

As much as the platform is friendly to newbies due to its user-friendly interface, experienced traders can benefit from these features. Users on Kraken have access to 69 cryptocurrencies. It also has a program that lets users loan out coins for rewards and margin trading. However, it is not advisable to go into those waters until you are conversant with cryptocurrency trading.

Since its conception, the platform has not had any hack threats. It is thus a favorite for many users who are conscious of their security. To open a Kraken account, follow these steps below:

- Go to their site and click the “Create Account” button. You will use your email to sign up.

- Provide your credentials to create the account.

- You will receive an authorization code from Kraken to activate the account.

- You will then submit Proof of Identity and Confirmation of Residence.

- The account allows you to set up a Pro, Intermediate, or Starter according to the crypto experience you have.

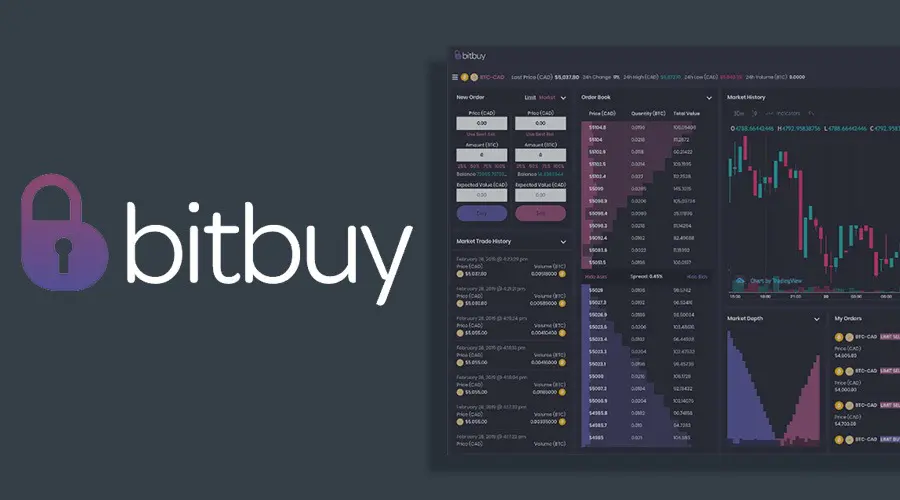

BitBuy

If you live in Canada, BitBuy is the best way to buy and sell Bitcoin. Their user experience is excellent, and their services are affordable. It also does not offer limited services in Canada, unlike other exchanges.

You will enjoy benefits such as six crypto assets, Financial Transactions and Reports Analysis of Canada regulation, and cold storage. The platform has been through several financial audits with no problems.

BitBuy has a strict registration process that takes some time, and you will thereby need to send several documents to verify your address and identity. You won’t be able to conduct any transactions for some days as you get set up on the platform.

Below are the steps to creating an account:

- Go to bitbuy.ca and click “Sign Up to Get started.”

- Add your email address, then create a password before signing in.

- You will receive an email where you will click the button “Verify my Email.”

- Sign in by choosing the text “Sign in Here.”

- Enter your email and password once more to sign in.

- Secure your account by adding your phone number.

- Fill in the required fields in the account settings to verify your identity.

- Finish your registration by clicking “Request Verification.”

What Is Bitcoin?

Bitcoin is a digital currency or a cryptocurrency with no government oversight. It is a contemporary form of money. The cryptocurrency is available to everyone in any place since it functions through peer to peer public technology.

Crypto has increasingly become popular because it has an exchangeability that is unique. The cryptocurrency was founded in 2009, and by 2017, there were almost 17 million bitcoins in circulation. The bitcoins in circulation at that time accounted for about $250 billion. The bitcoins in circulation have jumped to 18 million by 2019.

The crypto transactions are kept in a public ledger, with duplicates found on global servers. Miners go through transactions and collect them in what is a block before being added permanently to a blockchain.

The functionality is akin to a private account book but more of a high-tech version. The software allows all individuals to view and contribute to its framework.

The main purpose of creating Bitcoin was to make currency transactions that were electronic and didn’t have government interference. Since its inception, the platform has provided numerous benefits to individuals and businesses, such as security, payment mobility, identity protection, free visibility, and transparency.

Cryptocurrencies are primarily kept in digital wallets, with the question of ownership falling among online users. The digital wallets are accessed by a private key for virtual cash spending.

For measurement, Bitcoin is divided by three decimal spaces. A milli is equivalent to one-thousandth, while a satoshi is equivalent to one-hundredth millionth of a bitcoin.

Bitcoin can be converted into cash since it is an asset, and assets can be converted into real cash value. It is, however, not the only cryptocurrency in circulation. But currently, there are no solutions to converting Bitcoin to another currency.

How to Buy Bitcoin

You will require a cryptocurrency exchange to buy bitcoin, as it is the place where cryptocurrency buyers and sellers meet to exchange dollars for coins. There are numerous exchanges, but you will need to use an exchange that has ease of use, high security, and low fees as a beginner.

You should be aware of “trading pairs,” for example, BTC to USDT or USDC. In BTC/USDC, bitcoins are converted into Tether, a stable coin that has its value pegged to the US dollar.

You can pair your BTC to USDC using KuCoin and Binance. You will have to fund your exchange account before investing in Bitcoin. Confirm whether you’re exchange has a bitcoin Wallet on the platform. If there is no wallet, you will have to get your own. You can buy your first Bitcoin by placing the first order once the account is funded.

Depending on the platform, you can buy Bitcoin by entering the ticker symbol or tapping a button. You will then need to enter the figure you want to invest in. After the completion of the transaction, you will own a Bitcoin portion.

If a Bitcoin price at the time of purchase was $40,000, you would have to invest a similar amount to get 1 BTC. If you invest less, you will get a fraction of the total according to that amount.

Another way to buy BTC is through PayPal. However, this method has a shortcoming since you won’t be able to easily move the Bitcoin around. PayPal has reiterated on their website that you can only hold the Bitcoin you purchase on their platform in your US personal account. Transferring your cryptocurrency assets from your hub to another crypto wallet will not be possible.

Therefore, it might be best to consider another method of buying and storing your cryptocurrency.

Another way of purchasing Bitcoin is the use of credit cards. This is because transaction fees on cryptocurrency exchanges are very high when using credit cards. It is a possible method, but we would strongly advise against it.

Additionally, if you decide to use a credit card, it will be viewed as a cash advance and be subject to increased interest rates than you would have paid on regular charges. You should also avoid taking debt to make volatile and extremely risky investments.

Is Bitcoin Legal?

The answer to whether Bitcoin is entirely legal is not very straightforward. Cryptocurrencies are indeed treated differently depending on one’s location. The best way to phrase the question would be, “Where is Bitcoin legal?”

To make matters worse, countries seem not to agree on how they should handle cryptocurrency. However, peer-to-peer transactions are not in the governments’ hands and, as such, have continued to gain popularity.

As popularity grows, so are the questions about legality. We can say cryptocurrencies are still gaining traction, and they are unregulated. The fundamental thing you may have to consider is the location you are trading and whether it is an option that is financially viable for you.

Bitcoin is considered legal in the US, and the law views the crypto asset as property. This is, however, not the case in all other countries.

Countries like Salvador view Bitcoin as a currency and allow the purchase of goods and services using cryptocurrency. The US does not view Bitcoin as a currency but rather a commodity that qualifies to be called property.

Today, almost 51% of the world’s countries have accepted Bitcoin as legal, with the cryptocurrency being unregulated. 3% of countries consider the crypto asset legal but regulate its use, while another 3% have declared the currency illegal.

Is Bitcoin a Bubble?

It is well known that Bitcoin is the world’s most popular cryptocurrency. It has the largest market value and has continued to attract investors. There have also been negative headlines about the cryptocurrency asset. It, therefore, begs the question, “Is Bitcoin a bubble?“

According to Charles Kindleberger, a financial bubble is best described as the skyrocketing of asset prices that the fundamentals cannot give justification. It is basically an economic cycle characterized by a rapid escalation of market value. This mainly applies to the price of assets.

For instance, there is a lot of speculation surrounding Bitcoins, and many critics have termed cryptocurrencies as a bubble. For instance, there was a great surge in 2017, followed by a crash in 2018. Therefore, is this crypto asset a bubble? The answer will depend on how you look at the whole picture.

Cryptocurrencies exhibit the signs of a bubble. But it is hard to entirely label them as such because they have not fallen through to this day. So, we cannot really tell if that is the case.

For Bitcoin, there have been sharp increases in price over the years. However, the increase in prices has not gone as high as some of the bubbles in recent years. To a great extent, the value of Bitcoin can be associated with developers who work tirelessly to improve the ecosystem and other contributors as well.

However, Bitcoin is a relatively new asset that is yet to mature. The asset will have to go in increments and slumps before it matures. The best way to safeguard yourself against the market’s volatility is to always invest in what you can afford to lose.

How to Invest in Bitcoin

Investing in Bitcoin is a straightforward affair. Below are some of the steps you can take to invest in Bitcoin:

- Use a crypto exchange platform that is verified. Investing in crypto is akin to the exchange of coins. However, you need to do that on a verified platform in this case. Some of these platforms include eToro, Coinbase, and Binance. You will also buy Bitcoin with Veneno, credit cards, and PayPal. However, these methods have limited functionality.

- Have a fund for emergencies. As discussed earlier, cryptocurrencies are very volatile. Therefore, it will be prudent to have an emergency fund to cater to the unexpected costs before making an investment.

- Try to diversify your portfolio. As cryptocurrencies are very volatile, it may be wise to put some of your money in other bets that are safer.

- Evaluate your cryptocurrency investments. You should apply a trading strategy based on the fundamentals other than commercials or discussions on social media.

- Inform yourself to avoid scams. Many fake websites mimic the main domain, so you need to be careful.

How Is the Price of a Bitcoin Set?

Bitcoin, being a cryptocurrency, is not backed by the government or issued by the central bank. As such, inflation rates, monetary policy tools, and measurements of economic growth typically do not affect Bitcoin. The crypto asset fundamentally acts as a commodity used to store value. Below are the factors that affect the Bitcoin price:

- The supply and market demand for BTC

- BTC’s production cost through the mining process

- Competition from other cryptocurrencies

- News and talks in the media

- Regulations that affect its sale and use

How to Accept Bitcoin in Business

Accepting crypto payments in business is straightforward. Below are some of the steps you can take to accept bitcoin in your business:

- Set up a cryptocurrency wallet. The first step you will have to take is setting up a cryptocurrency wallet. It serves as a digital bank where you receive and send digital money. You should go for a wallet that holds different currencies, since you will have to accept different currencies.

- Integrate the cryptocurrency payments on your website. After ensuring your crypto wallet is set up and running, the second step is integrating payments into your website. If you operate on an e-commerce platform, there are numerous plugins that you can install to set up payment processing.

- Ensure you are cushioned against the drawbacks of cryptocurrency when you are accepting payments.

Is Bitcoin a Pyramid Scheme?

A pyramid scheme is an investment that relies on recruiting more members to make money. Typically, schemes promise investors high returns for minimal or no risks.

In the schemes, people at the top make money while those at the bottom incur losses. Some people are wary of Bitcoin and cryptocurrency because they think Bitcoin could be a pyramid scheme. But in reality, Bitcoin is not a pyramid scheme. Below are some of the justifications:

- Bitcoin has never promised its users any return on investment.

- There are no secret behind-the-scenes operations of Bitcoin.

- The transactions of Bitcoin are transparent and public.

- There was never a pre-mine with Bitcoin. The founders never allocated large amounts of coins to themselves.

- There is no single leader in control of Bitcoin.

From the above observations, it is clear that Bitcoin is not a pyramid scheme. It is a viable investment that you can consider dipping your toes into.

Bitcoin Pros and Cons

Bitcoin might have been released in 2009, but it is still considered a relatively new currency. There is a lot of misinformation regarding the matter, and you can dispel them by knowing some of the advantages and disadvantages of Bitcoin. Below are some of the advantages:

Advantages of Bitcoin

- The cryptocurrency provides its users with accessibility and liquidity.

- There is transparency in the operations of the crypto asset

- Users remain anonymous while trading with Bitcoin.

- There is independence from the government or central banks. You are not paying taxes on your cryptocurrency, and the government cannot freeze your assets.

- There is a high potential for good returns. Despite the vitality, users can use the changing value to their advantage.

Disadvantages of Bitcoin

Despite BTC being the largest crypto and having tremendous growth, some shortcomings come with owning and trading the asset. Some of the cons of BTC include:

- Volatility. This is the most significant challenge of owning BTC. The founders of Bitcoin set 21 million coins that could never exist. This made BTC scarce and left the price the only variable that ensures demand.

- A lack of regulation. Lack of government regulation can be seen as an advantage, but it is also a disadvantage. This is because, unlike regulated currencies, BTC does not offer any legal protection. You are also susceptible to scams since payments are not reversible.

- Bitcoin has limited use. Despite companies that accept BTC, it is still not accepted as a universal mode of payment.

- BTC is irreversible. Transactions that also occur are final and irreversible. Due to unregulated and anonymous transactions, there is a lack of security when trading BTC. Any amount sent to the wrong recipient or any wrong amount entered goes down the drain.

What Can I Buy With Bitcoin?

There has been continued growth in the number of institutions that accept Bitcoin. However, large transactions that involve BTC are still rare. For instance, there have been very minimal deals in the real estate industry conducted by BTC. Despite that, there are many products you can buy using Bitcoin. Here are some of the notable categories:

- Car dealerships

- Technological products

- E-commerce products

- Jewelry and watches

- Insurance

- News media

What Is Bitcoin Mining?

This is the rigorous process of discovering Bitcoins. Like gold, BTC is limited, and only 21 million coins are in circulation.

Coins are minted from intelligent computing power from computers all over the world. It may be complex at first, but you continuously get the hang of it as you progress.

You can send BTC at any time. However, you should ensure you keep tabs on each of them. This will ensure that you have digital cash that is fully functional.

The BTC network effectively fills in the need of intermediaries such as banks by processing all the network transactions before adding them to a list and then locking them. The miners are primarily the ones who do all the work and the Bitcoin mining difficulty varies as such.

BTC miners need a Bitcoin program (client) and a special computer. You become a miner once the BTC client is set on your computer. After that, you can take on other miners in creating solutions to complex puzzles.

How to Sell Bitcoin

There are several options for selling Bitcoin. You can buy Bitcoin from P2P marketplaces, traditional brokers, crypto exchanges, and Bitcoin ATMs. Likewise, these channels support the selling of Bitcoin. The only exception is some of the Bitcoin ATMs.

You may be wondering “How to sell Bitcoin“? You can place a sell order to sell Bitcoin on the same brokerage it was bought. A sell order saves as an instruction to the broker to sell the Bitcoin assets. BTC can also be swapped or exchanged for other stablecoins or cryptocurrencies such as Tether or Ethereum. This will assist you in preventing the value of your portfolio from falling.

If you intend on withdrawing the government-issued currency, you have to issue a sale order that involves your preferred currency. The majority of the exchanges will allow users to withdraw funds to their accounts.

What You Need to Know About Bitcoin

The first thing you should do is get acquainted with BTC before doing any serious transactions. If you are just getting into the cryptocurrency realm, there are things you need to know. Below are some of the essential things you should know about Bitcoin.

- You should secure your wallet.

- The price of Bitcoin is volatile.

- The payments of BTC are irreversible.

- Bitcoin is not entirely anonymous.

- Unconfirmed transactions are not secure.

- Bitcoin is still experimental, and more changes will be added to it.

- It is not an official currency. You will, however, have to adhere to tax regulations.

Who Accepts Bitcoin in 2022?

Small businesses have continued to adopt Bitcoin as well as large companies. Big companies that accept Bitcoin include:

- AT&T

- Wikipedia

- Microsoft

- Burger King

- Overstock

- KFC

- Twitch

- Subway

- Miami Dolphins

- Pizza Hut

- Virgin Galactic

- Dallas Mavericks

- Namecheap

- Norwegian Air

- Gift

- NewEgg

Some stores accept Bitcoin. These include:

- Alza

- Travel

- Bitcoin.Travel

- Old Fitzroy

- Zynga

- The Pink Cow

- Lumfile

- Fight the Future

- Museum of the Coastal Bend

- SEX

- Euro Pacific

- Intuit

The above companies and stores are just a few that will accept BTC in 2022. However, note that the list may be outdated since businesses may fail to offer updates when they stop receiving BTC as a mode of payment.

How to Get Free Bitcoin

It may be frustrating when one is new and wants to have Bitcoin for the investments that come with it. However, there are several other ways to get free bitcoin. However, be wary of fraud. Anyone willing to give free BTC with no effort is one.

You can get free Bitcoin through the following ways, but with some effort:

- Through faucets

- Cashback Bitcoin

- Through micro-tasks such as puzzles and surveys

- Playing games that award Bitcoin

- Through referral programs

- Through donations

- Through bounty programs

- Tipping bots

- Working out to Get BTC

- Through crypto air drops

How Does Bitcoin Mining Work?

For there to be digital cash that is fully functional, there needs to be a record of payments. This is what banks normally do. Therefore, how do we know that one person sent Bitcoins to the other? And how do we prevent double spending from preventing a person from sending the same Bitcoins to another user?

The solution to these questions is Bitcoin mining. The process eliminates intermediaries by processing all the transactions on the network before adding them to a list and locking them into blocks.

It is the miners who do all that work. They confirm all the transactions and keep them in a distributed public ledger. The miners of BTC need a Bitcoin program and a special computer.

How to Make a Bitcoin Paper Wallet

This is a straightforward task that needs a few minutes of your time. You will require a computer, the internet, and a few other materials.

Below are the steps you need to follow to create a Bitcoin paper wallet:

- Go to the paper wallet generator site

- Select the number of Bitcoin addresses you want to generate

- Print out the wallet

- Securely store the wallet away

- Use your private key to transfer or spend your Bitcoin

Why Do Bitcoins Have Value?

Bitcoin has value because it is widely acknowledged and convenient. These are the same reasons why paper notes and digital banknotes have value. Bitcoin also has value, since it is utilized to purchase and sell products. It also acts as a transfer of value.

Like gold and other valuable commodities, Bitcoin can be used as a store of value. The intrinsic value of cryptocurrency is the belief that it is a safe financial investment. The last point can be challenged, and you, therefore, need to weigh the options and make a sound decision.

How to Mine Bitcoin

Mining Bitcoin is a computing process that uses complex computations and computer code to create bitcoins. Codes are used to facilitate transactions, generate Bitcoin, and the assets of Bitcoin owners.

These data blocks are valid and create a transaction record in Bitcon’s public ledger. The blocks are referred to as blockchain, and they aid the system in addressing the double-spend problem.

A beginner miner should follow one of the approaches below and stick with them to the end:

- Invest in the equipment necessary for mining and set the profits aside

- Combine mining resources as part of the mining tool

- Apply the use of cloud mining resources on a subscription basis

Each of the approaches has its advantages and disadvantages. The decision will squarely fall on you depending on what you want to achieve and for how long.

Is it Safe to Use Bitcoin?

Financial commodities will always be risks, especially with cryptocurrencies, since they are not regulated. You should, therefore, always do thorough research before investing in Bitcoin.

The framework is well-created and can fend off the most sophisticated attacks. You should protect your BTC from risks such as volatility, insecure storage, and services from unreliable third parties.

Like any other financial investment, Bitcoin requires education about the product. Therefore, if you are willing to protect your assets and are educated about the risk, your Bitcoin investment will be safe. You can ensure you have protected your investment by keeping up with trends.

Investors Guide on How to Choose a Bitcoin Wallet

After investing in bitcoins, the next challenge is choosing a wallet to safeguard your investments. But choosing a wallet can be challenging, especially if you are a first-time investor. You should select your digital wallet with as much care as the traditional one.

Below are some of the factors you should consider when choosing your Bitcoin wallet:

- Security

- Reputation

- Private key accessibility

Choosing your Bitcoin wallet will also depend on your trading needs. You can use a mix of cold and hot wallets if you are a consistent investor to give you peace of mind. You can practice purchases and swift exchanging with hot wallets and cold wallets to safeguard bitcoin stores.

Despite the choice you make for a wallet, remember that bitcoins are very volatile. As such, they should be treated as other financial investments that bear risks. Therefore, invest wisely.