US Court Orders the SEC to Review Grayscale’s ETF Application

- The SEC failed to appeal the court’s previous ruling, leaving room for a final order.

- The crypto market reacted to the court order on Monday, with Bitcoin climbing above $31,000 for the first time since July.

- The SEC could still deny Grayscale’s application but would find new grounds for that.

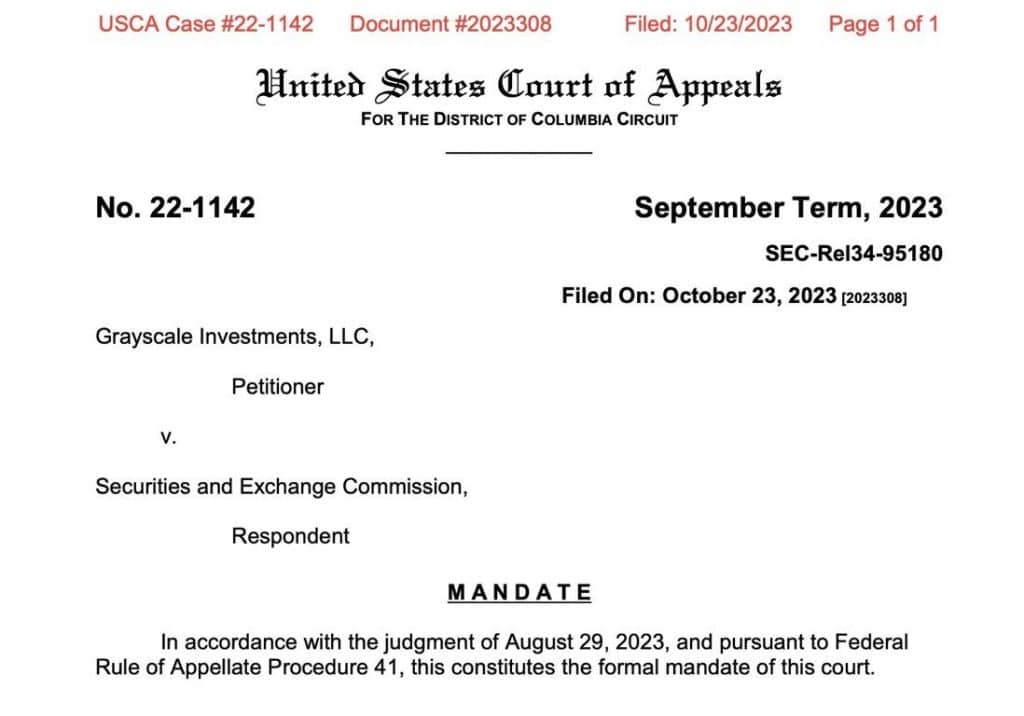

The US Court of Appeals has ordered the Securities and Exchange Commission (SEC) to assess Grayscale’s spot Bitcoin ETF application. Monday’s order serves as a formal closure of the case and further strengthens the court’s previous ruling that the SEC was “arbitrary and capricious” in rejecting Grayscale’s request to turn its nearly $17 billion Grayscale Bitcoin Trust (GBTC) into a spot ETF.

Following the ruling in August, the SEC was given 45 days to file an appeal, but the regulator chose to stay quiet since the deadline had already passed earlier this month. The SEC may still reject Grayscale’s application, but it would have to come up with a fresh defense that has nothing to do with its previous argument: that there isn’t a strong enough link between the spot market and the futures Bitcoin market. Should the regulator follow a similar route again, Bitwise and other Bitcoin ETF applicants have already presented a long list of counterarguments.

Hester Peirce, the commissioner of the SEC, said on Monday that she is “mystified” as to why her agency hasn’t yet authorized a spot Bitcoin ETF. The SEC is also dealing with spot bitcoin ETF applications from Fidelity, BlackRock, and Franklin Templeton.

Meanwhile, the Grayscale Bitcoin Trust (GBTC) will not have its shares directly redeemable for Bitcoin until a conversion is authorized. Interestingly, the company’s shares have increased by 33% in the last month in response to increasing optimism about its prospects.

Grayscale’s spokeswoman, Jennifer Rosenthal, said in a statement on Monday:

The Grayscale team looks forward to continuing to work constructively with the SEC to convert GBTC to an ETF. GBTC is operationally ready, and we intend to move as expeditiously as possible on behalf of our investors.

Digital asset proponents believe that the approval of the ETFs could be a turning point since it will allow for more widespread adoption of what some have criticized as a loosely regulated speculative sector. Industry controversies and bankruptcies, such as the collapse of FTX, contributed to the sector’s estimated worth being reduced by over half to approximately $1 trillion. Bitcoin makes up roughly 50% of the total.

It appears the entire crypto market anticipates a clear path for an ETF. In response to the court order on Monday, Bitcoin moved above $31,000 for the first time since July.