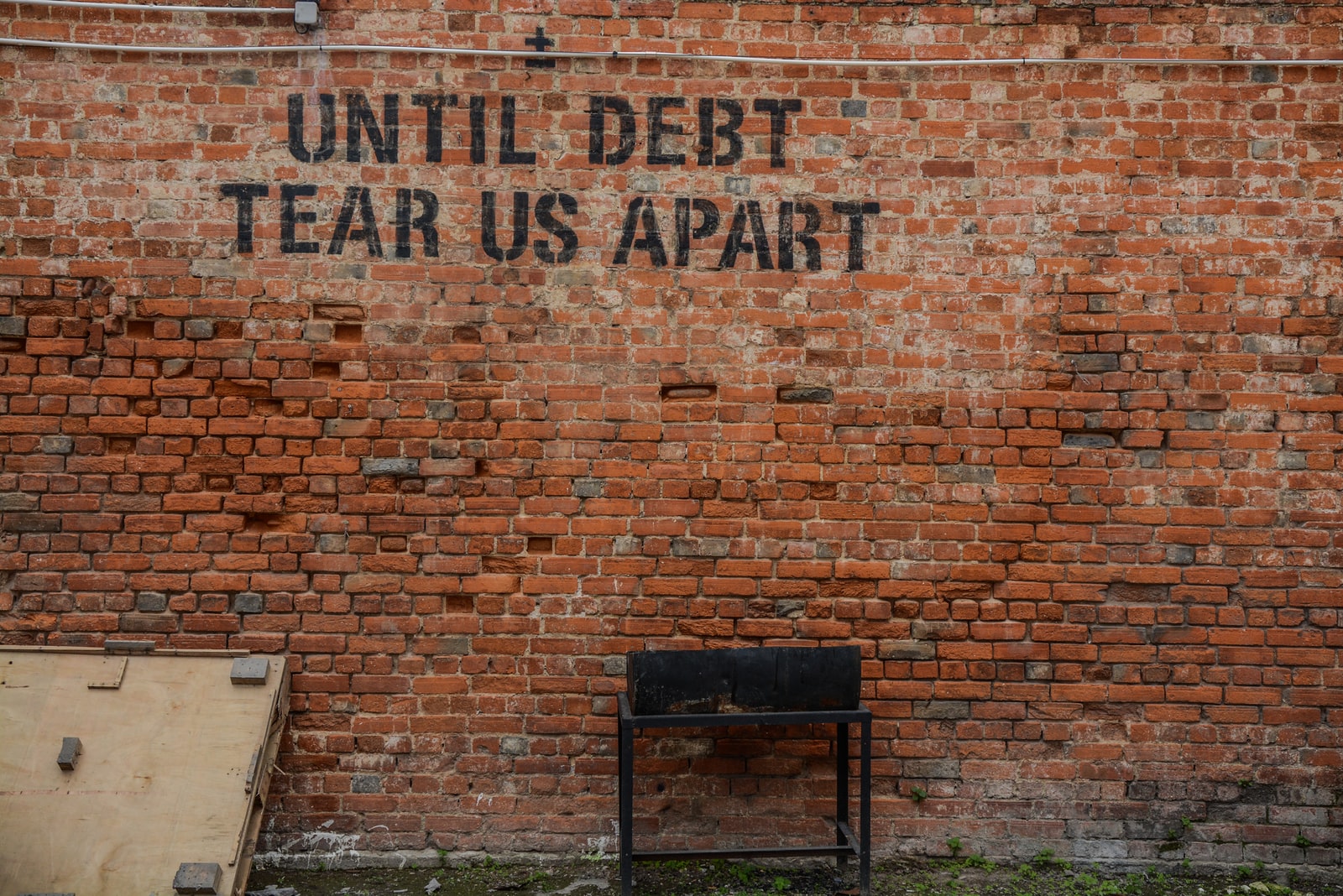

Russia has Defaulted Foreign Debt for the First Time in over a Century

- The development manifested after Russia failed to service its $100 million loans via two payment processes that elapsed yesterday.

Due to increased sanctions from countries in the West, Russia has ostensibly defaulted on its foreign-currency sovereign debt. The development manifested after the country failed to service its $100 million loans via two payment processes that elapsed yesterday.

Reportedly, the country intended to make the payment before the deadline but the sanction proved a major stumbling block.

Why the Crypto Community Should Care When Russia Defaults International Debt

Russia is a major global controller of the world’s crude oil reserves. As it is, the crude oil industry majorly controls humanity and its civilization.

Notably, the Country is bracing up for a possible dent in its reputation due to the default, a consequence Kremlin hoped to avoid. Previously, Russia has been able to repay bondholders comfortably.

The sanctions have sidelined Russia from the International payment structure, Yet, the country has been engaging in international transactions. The crypto market has hugely been blamed for that by the western military superpowers.

Last May, the U.S Treasury Department refused to renew an exempting clause that’s part of the sanctions. Previously, the U.S permitted the Central Bank of Russia to pay bondholders in dollars via some International financial institutions and the U.S.

In that term, Russia effectively serviced its debts by paying bondholders with that exemption. Just as expected, luring Russia into defaulting its loans has always been on cards for the United States to weaken Russia’s resolve.

The refusal to renew the exempting clause dealt Russia a huge blow. The Kremlin saw it coming when Moscow announced that future debts will be serviced using the Rubles via Russian financial institutions.

At the beginning of the month, Russian Finance Minister, Anton Siluanov indicated that the country had discovered a new payment structure. Subsequently, the Russian government transferred $100 million in rubles to its local settlement institution.

Nevertheless, the two bounds in contention are not attached to a ruble clause that encourages payment in local currency and then converting it overseas. The Minister conceded that bondholders might not be able to receive their returns due to the expiration of the special exemption.

In its defense, Russia argued that it can service the loan but it has been compelled into defaulting. Siluanov referred to the default as “artificial” because the country is willing to pay but an “unfriendly” country made it impossible.

Before failing to meet the deadline that elapsed on May 27, Russia Indicated that it had sent money to Euroclear, a bank that’s supposed to distribute the funds to bondholders. However, Euroclear refused to credit bondholders leaving the money stuck in its holding.

Reuters reported that some Taiwanese that hold the Russian Bonds denominated in Euros are yet to receive their interest return. The foregoing resulted in default because the due timeframe for payment had elapsed about 30 days ago.