Binance Removes Sanctioned Russian Banks From Its P2P Market

- Binance’s P2P services saw huge growth following the closure of LocalBitcoins earlier this year.

- Some crypto experts believe P2P platforms are still vulnerable to government manipulation.

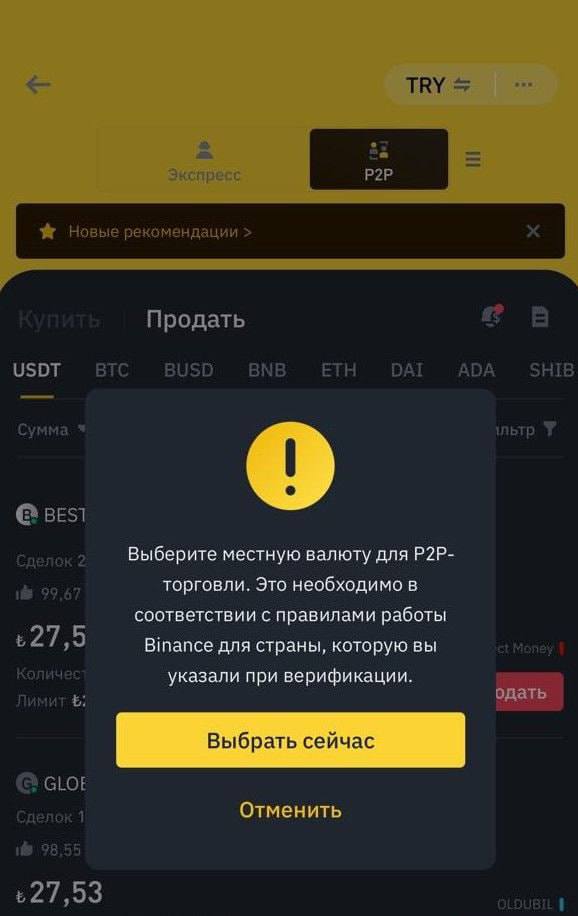

Crypto exchange Binance has taken measures to address concerns over its peer-to-peer (P2P) trading service involving sanctioned Russian banks. A recent report revealed that Binance had listed sanctioned Russian banks Tinkoff and Rosbank as transfer methods on its P2P platform. However, following widespread criticism, Russian news outlets claimed Binance had taken off these banks as transfer options.

But the crypto exchange simply replaced both names with the code words “yellow” and “green”. Both colors represented Tinkoff and Rosbank, respectively, on the Binance P2P platform. However, Binance finally removed both banks in response to the growing pressure.

A Binance spokesperson repeatedly claimed that the crypto exchange removed the sanctioned banks from its P2P market after learning that account holders were using its service to bypass sanctions.

The spokesperson added that Binance updates its systems to “ensure compliance with local and global regulatory standards. When gaps are pointed out to us, we seek to address and remediate them as soon as possible.”

While the removal of the sanctioned banks is a significant step, Binance’s P2P exchange continues to support several other Russian banks that are not sanctioned as payment methods. The P2P platform currently lists payment options from major banks such as Raiffeisenbank, Home Credit Bank, and Russian Standard Bank.

Interestingly, Russian users have other non-bank transfer options. They can leverage the services of payment processors like Payeer and Advcash to make such transactions.

In general, Russia has had to source for different ways to carry out transactions due to Western sanctions for its unprovoked invasion of Ukraine. Additionally, most Russian citizens have come to rely on cryptocurrencies to bypass these transitions. In response to this, global authorities warned crypto exchanges against allowing Russian citizens to evade sanctions via their platforms.

However, many believe Binance turned a blind eye to these users and allowed them to process transactions on its P2P market until it recently delisted the sanctioned banks. Regardless, it is important to note that Binance’s P2P services are handled by users, and the Binance servers do not handle fiat money.

Nonetheless, the situation with the Russian users has also raised concerns about P2P marketplaces. While proponents argue that such platforms help prevent government payment censorship, critics suggest they could be exploited for fraudulent activities.

Government bodies around the world are showing huge interest in regulating crypto activities. However, most crypto users believe that these government policies pose a threat to the future of Web3 and the push for decentralization.