CZ Reacts to EU’s Passage of MiCA

- MiCA makes the EU the first region to implement a comprehensive regulatory framework for crypto assets in the world.

- Some crypto users criticized the US for its actions against crypto.

- Binance, according to CZ, will make changes to comply with the new framework.

After two delays beginning in November 2022, the European Parliament voted to pass MiCA on April 20. The law proposes to harmonize the regulatory environment for crypto assets throughout the member states of the European Union.

European Union legislators still have to review MiCA for legal and linguistic problems and publish the bill in the EU journal. However, many believe the regulation might take effect as early as 2024, depending on the European Council’s decision.

The majority of leaders in the crypto sector praised the bill’s passage. Others criticized the United States for appearing to lag behind in the regulation of digital assets, a development that could push businesses to the EU with the introduction of MiCA.

According to reports, over 500 members of parliament voted in support of MiCA. Mairead McGuinness, the EU’s commissioner for financial stability, believes the EU is “ahead of many other jurisdictions” in terms of cryptocurrency legislation.

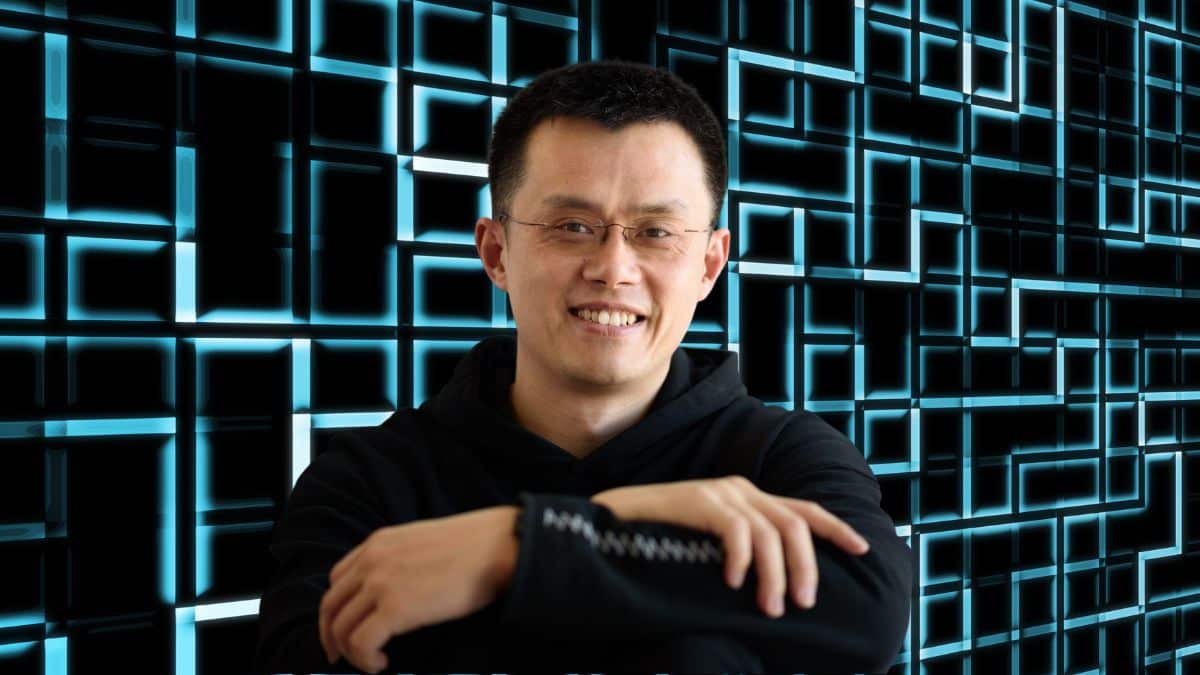

Reacting to the news, Binance CEO Changpeng “CZ” Zhao said he would start making modifications to the exchange in the next 12 to 18 months in order to comply with the proposed new framework. CZ wrote on Twitter:

The European Parliament voted for MiCA to be implemented. This means one of the world’s largest markets is introducing tailored regulations for crypto to protect users and support innovation. The fine details will matter, but overall we think this is a pragmatic solution to the challenges we collectively face. There are now clear rules of the game for crypto exchanges to operate in the EU. We’re ready to make adjustments to our business over the next 12-18 months to be in a position of full compliance.

The European Parliament also approved the “Transfer of Funds Regulation,” a separate piece of legislation that requires cryptocurrency providers to identify their customers in an effort to stop money laundering.

The decision was made in response to a debate on Wednesday, during which legislators mainly backed proposals to require crypto wallet providers and exchanges to obtain licenses in order to operate across the EU, as well as issuers of stablecoins pegged to the value of other assets to keep adequate reserves.