US Authorities Are Slowly Trying to Ban Crypto

- Crypto experts believe the US government is slowly isolating crypto companies.

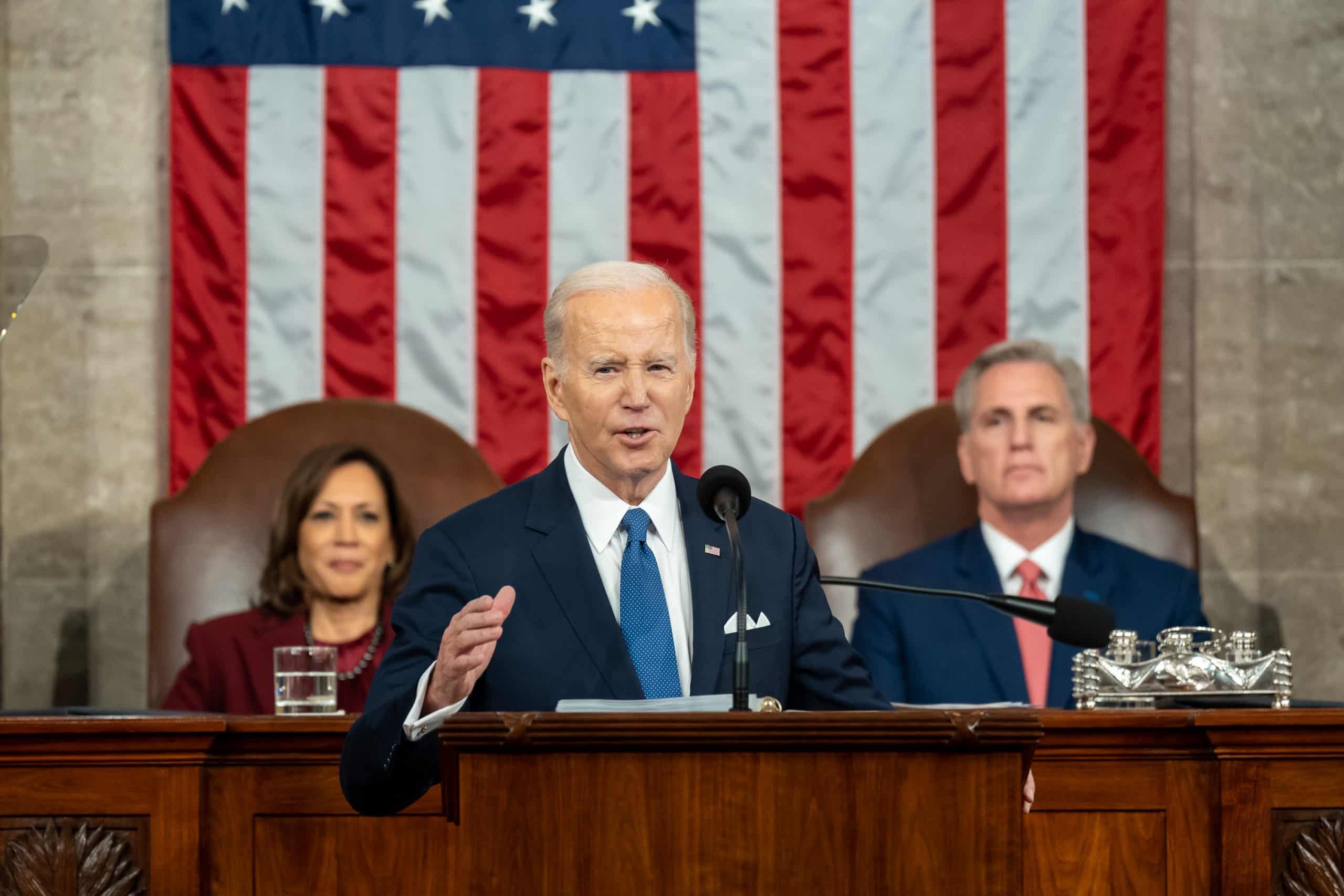

- The Biden administration recently warned about the risks of deepening ties between the crypto and traditional finance worlds.

- Recent efforts to regulate the crypto industry have cast doubt on the industry’s future in the US.

The US government has been accused of putting pressure on banks dealing with cryptocurrencies. According to a Cointelegraph report, US authorities are embracing an age-old tactic to untangle the traditional finance world from the crypto industry by spanning “multiple agencies to discourage banks from dealing with crypto firms.”

According to Nic Carter, co-founder of Coin Metrics, the goal of this approach is to make crypto businesses unbanked. Carter claims to have spoken with a couple of crypto and bank executives, and “they tell me they are facing immense pressure from the Fed [Federal Reserve] and FDIC [Federal Deposit Insurance Corporation].” He added that “founders are telling me that they can’t get bank accounts anywhere for new startups.”

Carter explained, saying,

Regulators threaten and bully bank leadership behind the scenes, then publish public “guidance,” stressing that banks are still free to custody crypto or service crypto clients. In reality, they’re not free to do this, by any means.

Carte also wrote in a Substack post that “the U.S. government is using the banking sector to organize a sophisticated, widespread crackdown against the crypto industry.” He added that “the administration’s efforts are no secret; they’re expressed plainly in memos, regulatory guidance, and blog posts.”

Marcus Sotiriou, market analyst at digital asset broker GlobalBlock, said in an emailed comment that such a move by the US government would be “a huge mistake from a U.S. perspective.” Sotiriou believes banning crypto “would result in the rest of the world getting ahead in the important crypto and blockchain technology revolution.”

Any Truth to Carter’s Claims?

While Carter’s claims seem surprising, recent statements from some US regulators appear to back his concerns. For example, last month, the Fed, the FDIC, and the Office of the Comptroller of the Currency (OCC) issued a joint statement warning about the dangers of banks getting involved in cryptocurrency and urging them to cease doing so out of “safety and soundness” concerns.

Secondly, a new Signature Bank policy led to Binance’s announcement last month that they would only execute fiat transactions for $100,000 or more. Signature Bank was also one of the US financial institutions that announced plans to cut back on crypto services and close customer accounts.

A recent Forbes report claims the Biden administration is “quietly” trying to ban Bitcoin, Ethereum, and other cryptocurrencies. The move, according to the report, was dubbed “Operation Choke Point 2.0,” which refers to a 2013 government campaign that tried to cut off industries deemed undesirable from banking services.

The Biden administration has previously warned that Congress needs to “step up its efforts” to regulate the cryptocurrency industry, adding that doing otherwise and allowing ties between cryptocurrency and the financial world to deepen would be a grave error.

Some crypto experts believe a new administration is the only way out for crypto’s survival in the US. However, others, such as Binance CEO Changpeng Zhao, believe that Wall Street giants are at risk if they fail to embrace crypto.