MAS Plans to Discourage Retail Speculations with New Policies

- MAS has adopted a less restrictive approach for digital service providers in Singapore.

- The regulator eased the requirements needed to qualify as an accredited investor.

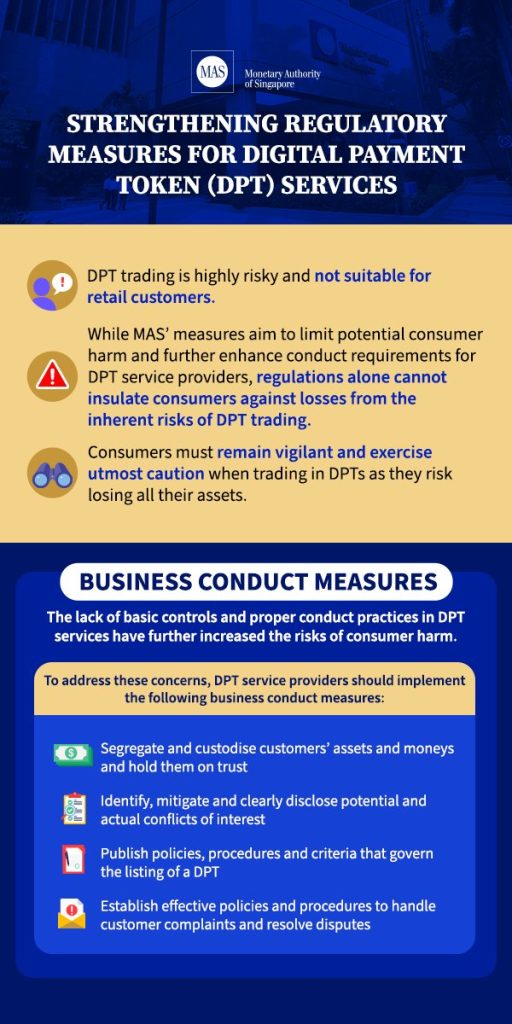

New rules for Digital Payment Token (DPT) service providers in Singapore show that the Monetary Authority of Singapore (MAS) plans to deter retail clients from speculating on cryptocurrencies. MAS has focused on developing clear policies for crypto operators to prevent potential harm to users and to guarantee the security of those who trade cryptocurrencies.

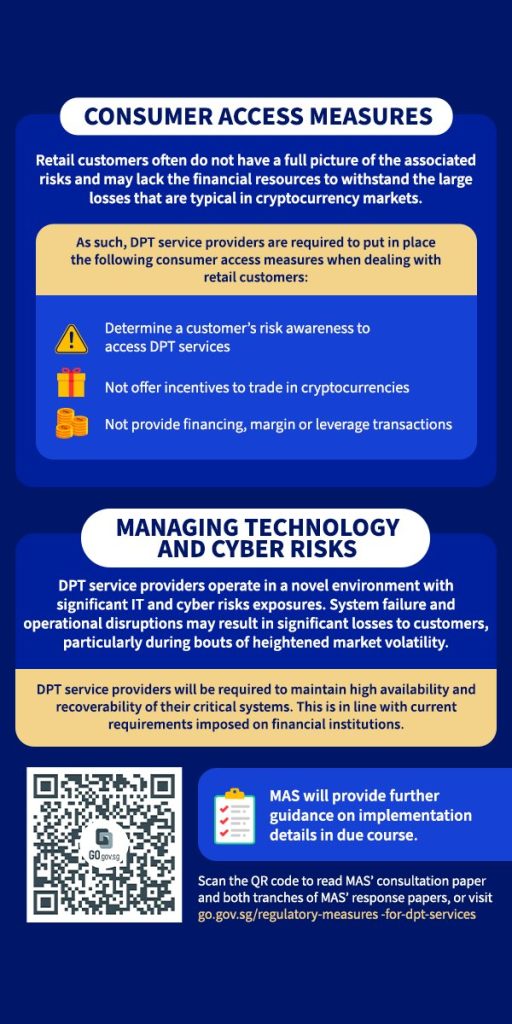

MAS recently published its second final round of comments on a consultation paper outlining suggested rules for cryptocurrency service providers. As stated on Thursday, the central bank maintained its requirement that cryptocurrency companies dissuade regular clients from speculating on cryptocurrencies by refusing to provide financing, margin transactions, or trading incentives.

The MAS further requests that crypto firms verify a customer’s level of risk awareness prior to granting access to the services and avoid accepting payments made with locally authorized credit cards.

MAS first received public comments on its proposed policies for digital payment service providers in July. Providers were required under the first proposal to place customer assets under a statutory trust for safeguarding before the end of the year.

Former MAS regulator Angela Ang, who currently serves as a senior policy adviser for blockchain intelligence firm TRM Labs, praised MAS for its less restrictive rules. Ang claimed the regulator “landed on slightly less restrictive measures in areas such as the inclusion of cryptocurrencies in determining customers’ net worth.” She remarked that “this shows that MAS is listening and is willing to consider industry feedback, even if they do not always agree.”

Part of MAS’ flexible policies includes relaxing the requirements for becoming an authorized investor and making it clear that some cryptocurrency assets can be used toward the required S$2 million ($1.5 million).

Commenting on the policies, Ho Hern Shin, deputy managing director for financial supervision, said:

While these business conduct and consumer access measures can help meet this objective, they cannot insulate customers from losses associated with the inherently speculative and highly risky nature of cryptocurrency trading.

Additionally, MAS has given crypto exchanges the freedom to create their own standards for listing coins, granted that they acknowledge any conflicts of interest, publicize listing requirements, and set up a dispute resolution process for users. MAS plans to gradually introduce these rules in mid-2024.

MAS has adopted a less restrictive approach than regulators in areas like Hong Kong, which only accepts tokens that meet its requirements. Others, like the United States, have yet to release a comprehensive policy for the crypto industry. But many believe the recent Binance settlement with the DOJ could set the tone for clearer regulations in the US.