The Future of Mining Finance

Firms looking to acquire mining rigs in the current market will have to look beyond stock issuance. They may have to borrow against their machines or already mined crypto assets or even put themselves up for sale.

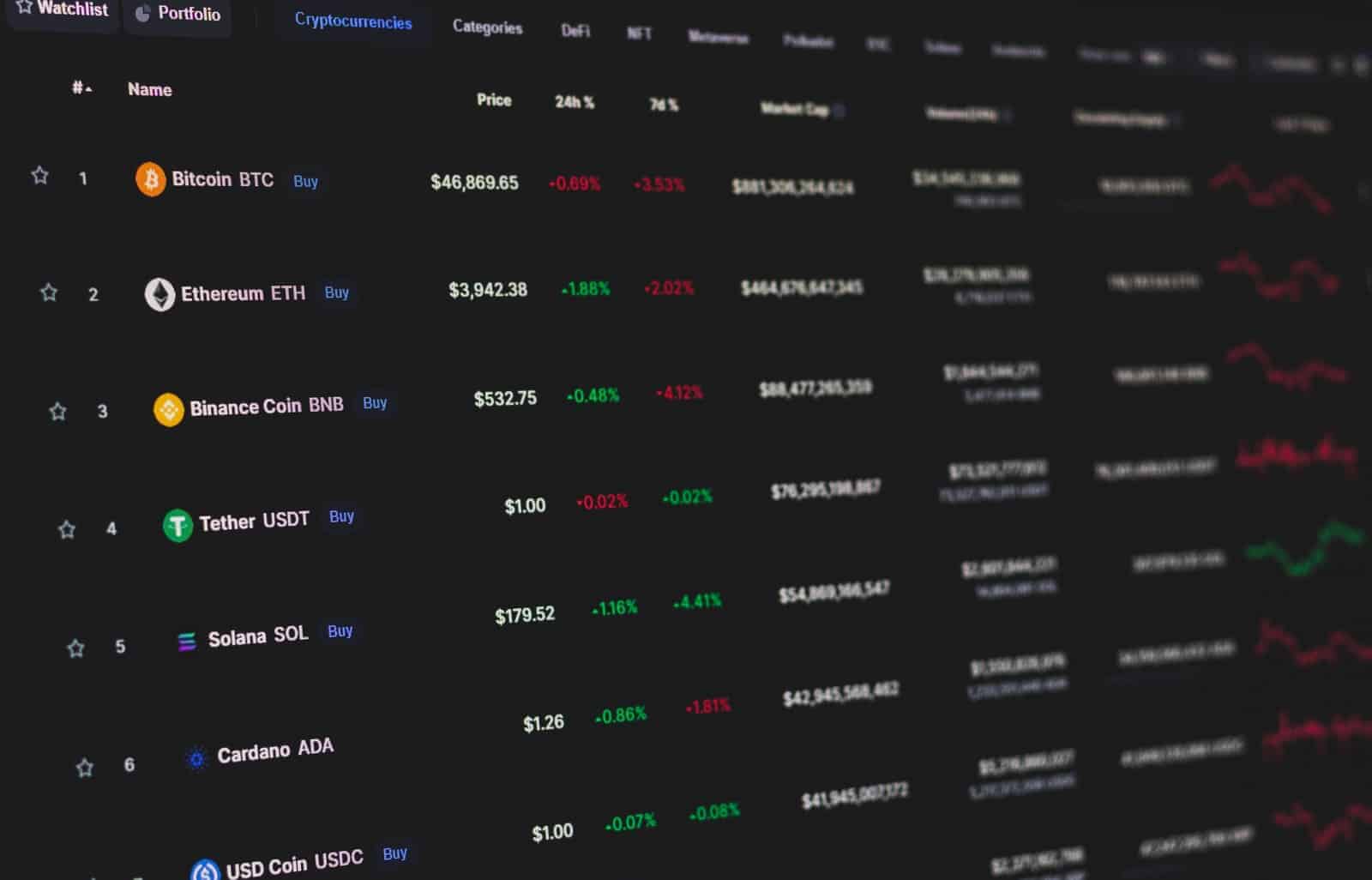

Back in 2021, when bitcoin (BTC) was hitting new price highs consistently, both public and private investors were pouring money into crypto mining operations. With the current price levels of the crypto market assets most especially bitcoin, investors have grown more risk averse to the industry.

Easy access to capital is important for the growth of any industry, it is not any different for cryptocurrency-based companies. This is mostly because these companies require a large amount of funding for infrastructure and equipment to prosper.

The industry has already seen the rise and fall of many companies and investors are now more cautious when it comes to putting money into the space. However, this does not mean that there is no longer any opportunity for growth in the mining sector.

With miners’ profit margins being compressed from their peak of over 90% to around 60% this year, operating in this industry is now tougher than it ever was.

The current situation hasn’t stopped the expansion of mining operations; several firms continue to add more hashrate capabilities.

There are still several ways in which companies can raise capital and grow their businesses. Alternative financing has grown significantly over the past decade and today represents more than $8 trillion in total assets under management.

Many traditional investors are not fully sold on investing directly in cryptocurrencies due to government regulatory concerns. This is why investors put their money into public crypto mining equities as a proxy for investing in bitcoin.

By investing in these mining operations that hold onto their mined bitcoin or crypto, these investors can profit from the mined crypto at a lower cost than its market price, while owning a real business.

Ben Gagnon, chief mining officer of Bitfarms (BITF) explained that “Public miners are the best option for most investors because they provide exposure to this fast-growing asset class through their existing portfolios with liquidity to more optimally enter and exit positions,”.

Gagnon went on to say that “BITF is one of the oldest and largest public miners, with a long history of successful operations. We welcome new investors who want to participate in this exciting sector but don’t want the complexity or high barrier to entry associated with owning and operating their own facility.”

Globally, there are about in assets under management that is now dedicated to alternative financing. Of this $8 trillion, crypto mining is a mere fraction, with alternative financing comprising $10 billion to $15 billion in annual mine financing, or less than 1 percent of the global alternative financing total. This indicates a market opportunity for mining equities to raise significant alternative financing allocations.

In the past, mining has been largely financed through traditional means such as equity and debt. However, with the rise of digital assets, a new type of financing has also now emerged: crypto mining. Crypto mining is the process of using computing power to verify transactions on a blockchain and earn rewards in the form of cryptocurrency. This type of financing has become increasingly popular in recent years, as it allows miners to raise capital without having to sell equity or take on debt.