Some Crypto Fund Managers Prefer These 3 Altcoins to Ethereum (ETH)

Three crypto asset managers increased their portfolio allocations to altcoins at the expense of Ethereum (ETH), according to a survey conducted by CoinShares.

Looking at the big picture, investors have increased their exposure to digital assets to about 1% from 0.5% recorded in March. Surveyed fund managers have about $200 billion in assets under management (AUM) combined.

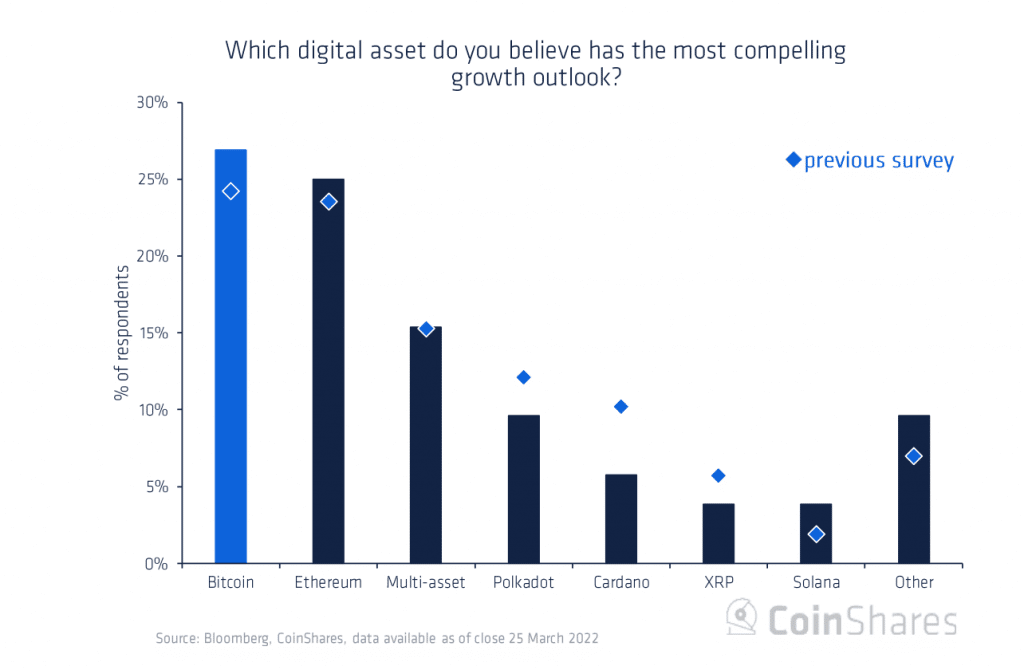

As many as 39% of respondents said that Bitcoin (BTC) has the most compelling growth outlook. This is not surprising given the recent collapse of stablecoin UST as investors prefer to invest in less-risky digital assets, like Bitcoin and Ethereum.

Still, fund managers increased their allocations to Ripple (XRP), Cardano (ADA), and Polkadot (DOT), shifting away from Ethereum.

“While positions on Bitcoin have changed little, investors are increasingly adding to altcoins. The survey highlights increasing allocations to Polkadot, Cardano and XRP at the expense of Ethereum.”

The survey results show that Ethereum portfolio allocations fell from roughly 25% in March to just over 20%. On the other hand, the three abovementioned altcoins have seen their market shares increase. For instance, the XRP allocation moved to roughly 6% from around 4%.

Similarly, Polkadot saw an increase to 13% from 9% while Cardano recorded the biggest jump, going from 5% to 12%. In addition to Ethereum, Solana has also seen its portfolio allocation shrink to 1% from the prior 4%.

When it comes to the reasons why fund managers are investing in digital assets, key factors considered include diversification and speculation. As much as 27% of investors said they invested in cryptocurrencies for speculative reasons, up from about 20%.

“Diversification remains a key reason for investing in digital assets, although it has declined, likely due to Bitcoin’s increased correlation to tech stocks and skepticism over its true diversification merits.”

As far as risks are concerned, a government ban and regulatory concerns are the top risks mentioned by fund managers.