The Balance Ecosystem (USDB) Claims It Can Preserve Its US Dollar Peg

The Balance Ecosystem (USDB), a project that develops solutions to help algorithmic stablecoins preserve their peg to the US dollar, unveiled new ways to address the major issues that led to the recent collapse of the TerraUSD (UST).

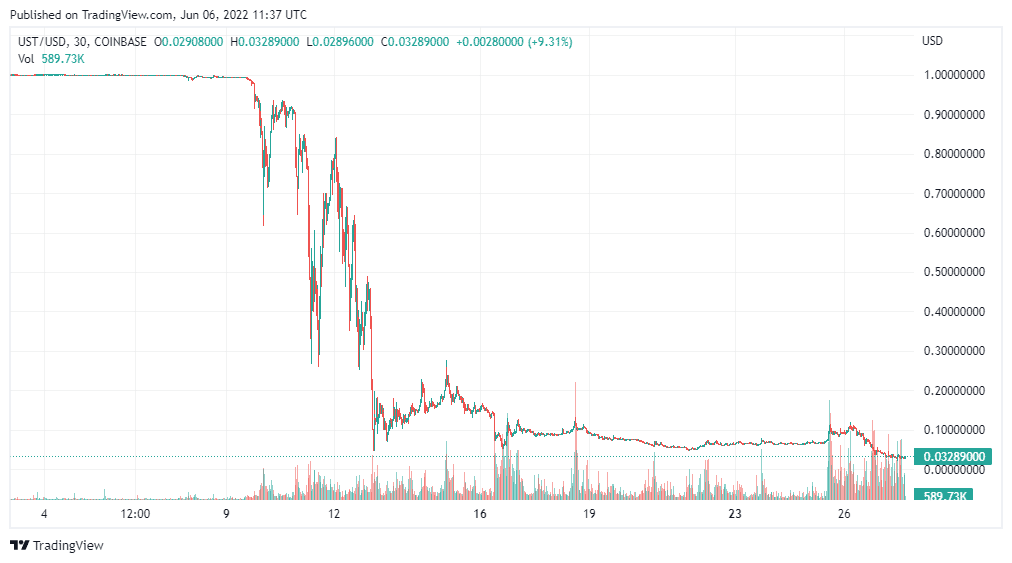

The drastic fall of UST left a significant impact on the crypto market, shaking investors’ confidence in algorithmic stablecoins and their role in decentralized finance (DeFi).

However, the Balance Ecosystem claims it has the solution to tackle those issues that resulted in the collapse of these assets, leading to substantial selloffs of billions of dollars.

The project developed a “next-generation” algorithmic stablecoin called USDB, whose supply is reportedly heavily controlled to prevent it from losing its peg to the US dollar. The team working on the project said they are thoroughly testing USDB’s durability, hoping that these tests will resolve any potential issues and improve the coin by the time it is massively adopted.

While many stablecoins today are built on numerous value-preserving assets, this is not the case with the USDB, the team claims, nor will the coin be paired with another cryptocurrency as in the case of UST and its sister coin, LUNA.

In contrast, USDB’s treasury uses a group of decentralized assets for censorship-resistant backing. As such, the liquidity of these assets can be easily sold if the stablecoin’s peg to the U.S dollar needs to be urgently restored.

The project also utilizes another mechanism that ensures that liquidity providers are not able to “manipulate or cause significant shifts in price.” The leaders behind the project said that “protocol-owned liquidity” plays a key role in ensuring a flexible supply that can be redeemed for $1 anytime.

There are reportedly three to-be-launched mechanisms that aim to preserve USDB’s peg to the US dollar, with the project considering additional mechanisms as well. These include collateralized debt positions which aim to generate income for peg maintenance; adjusting the FHM’s tokenomics to enhance the stablecoin’s supply backing; and backing a portion of USDB using fiat currency.